Detaching from the Matrix…Small steps to big rewards

We are in a mess. We got this way because people forgot that the power brokers of the world treat life like a chess game, and we think of life like a daily or hourly experience.

We are ending another decade in human history. Normally there is a positive push into each new decade that comes with invention, creativity, etc. and yet for this new decade there are world meta issues at play that will change how the world will look over the next 10 years. I give you what I see as opportunities that I may be participating in for the next ten years in this article.

As I write this, we are only a few short weeks away from saying Adios to another decade and beginning yet another new one - the roaring twenties! Not the roaring twenties from 100 years ago, but OUR roaring twenties. What will they bring, and what opportunities will present themselves to the unconstrained?

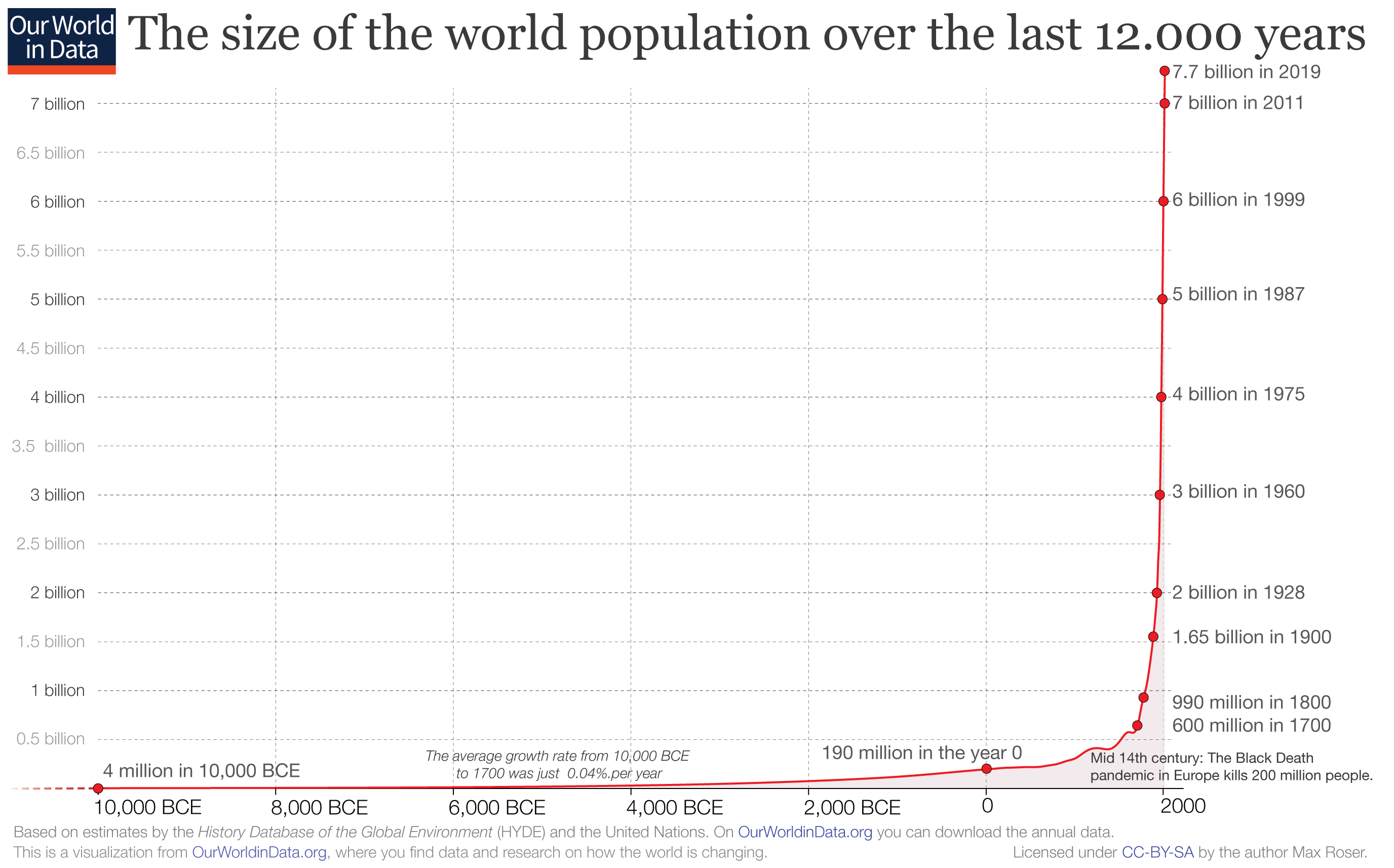

It is no secret that we are exhausting the resources of this planet. Since the day I was born to today, we have almost doubled world population. That’s a scary thought. This chart is even scarier:

Lay this chart over the rise in carbon dioxide & climate change and you can see the problem. It isn’t that we are destroying our world with greenhouse gases (which may well be the case), but we are destroying our planet with too many humans on it.

Why is this happening? Technology for the most part. We’ve invented ways in medicine to destroy diseases that previously had reduced life expectancy to 40 or 50 years. So the natural attrition rate here took care of people. But at the same time, with the rising population, there are more babies born with a higher success rate in births, so you get the double whammy effect here. And this continues to evolve over time, rising populations by factors each year.

The resulting impact appears to be subtle at first, but gradually amps up. Climate is something being discussed right now because it has an immediate and obvious effect that we can all see. Temperatures rise, extreme weather events intensifies, regions previously habitable become uninhabitable, sea levels rise destroying coastal regions, etc. If you have ever considered buying a beach house as a holiday home or moving to the coast, you must have either reconsidered that or at least factored in rising sea levels into your investment strategies. If you haven’t, you have no business investing at all.

We have to consider that during our lives, this is the new normal. Even if the UN manages to force all countries to go 100% green energy to stop climate change, they are not stopping babies. They are not addressing food and water shortages, increased trash and pollution, etc.

As I write this article (Q4 2019) there is a general social & cultural attitude away from liberal and green attitudes to energy, recycling, etc. as the current administration is more interested in finding jobs for coal miners. With that, the country stops looking at green energy projects. They put that in a partisan spotlight that only seems to shine during Democratic occupants of the White House.

That’s where the opportunity presents itself. While everyone else is not paying attention to something that you can reliably predict as being a big thing in the next 5 years or so, you can. And that means you follow the mantra I have always preached and that is that you catch a wave on the horizon by seeing it well ahead of it coming to you, getting prepared and paddling like crazy as it presents itself. That’s how you should be thinking about green energy and recycling as opportunities.

Regardless of your political inclinations, population increases like we are seeing occur consistently and over different political party tenures. You can reliably predict world population to be over 10 billion in the next 10-20 years based on these charts, so you should be asking yourself:

“What opportunities are presented to me as an investor or business leader, that come with rising populations like this?”

Here’s a few ideas:

Some of these things are macro and you probably can’t see the impacts directly. Other things are more localized and you should consider going to those regions and seeking out opportunities that fit within a general framework that has some high chance of future growth.

But here’s the really interesting thing.... Everyone else is watching CNBC and worrying about the DJIA today. They never present graphs showing trends over 5 years because this is a 24 hour news network that has to feed you with immediacy rather than macro truth. It is really easy to fall prey to thinking all is well and today the markets are up, so you shouldn’t think about “real asset” acquisition, when the news media is only interested in telling you the news of the day. There is no such thing as a “News of the Five Years” TV channel. Therefore you can’t invest using that information because investing takes at least a five year time frame. All they give you is a speculator’s view on finance on the TV shows, and that’s only good if you are a day trader.

The true contrarian investor is looking well over the horizon and to emerging trends and it would seem pretty obvious to this one that world population is going to be the elephant in the room for the next 10 or so years, and with that will emerge enormous opportunities to those that don’t fear to tread down that path.

You cannot deny that the largest country in the world by population will steamroller over everyone else - China. After we allowed them entry into the WTO, they have been remarkable in their ability to muster their forces and propel themselves on the world stage. Using their massive population as a cheap labor weapon, they have successfully moved world attention to their shores, and with the war chest of cash that was accumulated, they have created an economic powerhouse. They borrowed and invested in their own infrastructure for the future - a future of hundreds of years into the future.

Yet they have 1.3 billion people to deal with. This creates enormous issues of resource management, housing and social cultural control. Remember this is a communist society, where the state ultimately controls everything. By western standards, they have implemented draconian controls over regions and removed free speech and unconstrained life from their citizenry. And one must consider that investing in any enterprise either directly in, or under the control of, China is going to be surrounded with some partnership of the state in China. For me, I can’t do that. But for many, including a lot of US corporations, they have put aside their own cultural norms to embrace this powerhouse.

As China continues to grow and will, in a few more years, outstrip the dominance of the USA on the world stage, we must ask ourselves what the rise of China will mean in terms of power shifts in the USA and how the world may look in 2030 in the USA vs. how it looks in 2020.

Following WWII, and the US dominance after that period, the Bretton Woods Conference, held in the Mount Washington Hotel in Bretton Woods, New Hampshire, forged the economic world system that we have today. However it was initially an agreement that all world currencies of the attending countries would be tied to Gold as a backing. This established the IMF (International Monetary Fund) and the IBRD (International bank for reconstruction and development) which the US (at the time) controlled two thirds of all of the world’s gold, and therefore insisted that the world’s economies should backed by BOTH Gold and the $USD. Although the Soviets didn’t ratify this agreement, a sufficient number of other countries did, and this became the world economy of the 20th century.

The rise of the next few decades saw a level of prosperity in the USA never experienced before - mainly due to the dominance of money control. However in 1971, when the US left the Gold standard, the world economies now were either forced to “free float” their currencies, or tie them to the $USD. But with the $USD not tied to anything, it meant that all countries had to embrace the “Full faith and trust of the United States Government”.

To me, this is a house of cards waiting to collapse now. If the USA is no longer the dominant economy in the world (likely based purely on population demographics and trade shifts, to be the case within the next five years), the rest of the world will likely shift to the dominant trading country, China, and follow them economically. I have seen this personally with Australia’s dominance on China for trade and how the Chinese culture has begun a takeover of Australian sovereignty and ownership of natural resources. Although there is much push back in the Australian population against this, the reality is that due to economic ties, Australia could not survive economically without China - mainly due to their addiction to debt. Detaching from China for trade would be a massive “cold turkey” off the debt addiction that would not be survivable. And if there is a general cultural perception that the USA is not trustworthy, a complete detachment from US alliance could be a possible future if it threatens the Chinese relationship.

Hence the dominance of the USA is waning and China rising. With that could be a re-negotiation of other member states in the world that look to China to provide a world currency backing. Or (in my opinion a more likely scenario) of a return to the Gold Standard of pre-1971 as the backing of national currencies.

The one potential that could also change this is crypto-currency. Gold has its role here, but it is not fluid in its ability to move from place to place. By using something akin to Bitcoin, which is backed by mathematics and has a limited supply characteristic like Gold, we could see this become the backing of world currencies should China decide to throw the USA under the bus.

And they can - they hold $1.1T in US government bonds which could easily be sold off, reducing the power of the $USD and forcing a general collapse in the US economy. The US powerhouse is based on consumption of goods from other regions and is a net negative exporter. So with the balance of trade firmly held outside of the USA, any reduction in consumption due to hyper-inflation or reduction in the purchasing power of the $USD will force other countries to turn to China as their dominant trading partner. And there is nothing the USA can do about that, despite decades and decades of world dominance.

To the contrarian investor, I would suggest having a position in Gold and potentially a “neutral” crypto-currency that is widely accepted as meeting the underwriting needs of a world economy. One could argue that the IMF could create this, but since the IMF is directly tied to the USA through it’s history, any reduction in the faith of the USA to live up to their deals may mean that other countries move away from the IMF towards something they can all agree on not requiring allegiance to any other power. My bet would be that Bitcoin could play a role here, although it will come down simply to adoption. If we start to see other countries using it more as a backing to their own Fiat currency, that would send a strong signal that this could be the shift away from US dominance.

I personally began a acquisition cycle on Gold back in 2016, and so far it has shown about a 20% gain. I am looking for a market sell off for BTC, before I re-enter that market in any meaningful way even though purchasing Ethereum as an alt-coin investment in 2018 served me well and paid entirely for my surgical procedures in 2019.

This, I believe, is the key indicator for investment. Our “plastic problem” is out of control. Single use plastic containers, predominately water bottles, are destroying our oceans.

It doesn’t surprise me that large US corporations, such as Dell, see this as an important area to get involved in.

Yet one thing I discovered in my travels in 2019 was that scientists in the Atemajac Valley University in Guadalajara, Mexico, have invented an alternative to plastic based on prickly pear cactus.

I don’t believe this can scale to the level required based on anything needed, but it proves that technological invention should pave the way for a single use plastic alternative, emerging as a huge opportunity for investment. Additionally, however, we have the legacy problem of current waste levels and how to deal with that. We humans opted for a non-biodegradable but cheap container (plastic) and now we will pay the real price of what that really costs. We have to clean it all up. If there are scientific inventions to force degrade the plastics in such a way that doesn’t create century long waste issues, this would be a massive investment opportunity.

My eyes are wide open looking at emerging inventions in this space.

So I’ve unveiled a couple of ideas here where I am looking. There are many others, but they are still either perculating or in their infancy. I suspect that they will expose themselves over the next year or so, but I would caution you to look at what the mainstream media are telling you as new trends in the coming decade. As we near the end of the “tens” decade of the 21st century, you will hear a lot of discussion, speculation, talks, etc. on TV as to what to expect in the next 10 years. The reality is no one really knows.

The one thing you can bank on are these “elephant in the room” problems and the biggest is world population. Second to that is the waning power of the USA and the rise of China and how this may have massive change in world economics. With that, the rise of the risk of war as there will be winners & losers with change, is high. That was the case 100 years ago, and we all know how that turned out. Germany’s expectation to repatriate money to cover the costs of their WW 1 advances meant historical events over the 20th century that changed the way we see the world dramatically. If there are shifts in economic power, particularly with a highly armed population in the USA, we could see the risk of conflict yet again. I hope not. But it is clear to me that the world economic dominance is shifting in a way that cannot be stopped and having a “bug out plan” isn’t such a bad idea in times of change like this.

I am trying to be as optimistic about the future as possible, but in a world of increasing population, decreasing jobs due to automation, and changing economic dominance, there has to be some peripheral damage. There always is and we haven’t seen anything like that yet. Our attention is constantly taken from us to the immediacy of the 24 hour TV news cycle, and that doesn’t tell the story of what is really going on.

The next 10 years are pivotal in the new world that is emerging and you can choose to be a winner in investments based on real world observations, or put your faith & trust into counter parties that (when the SHTF) don’t want to be your partners anymore. Good luck, but ultimately as US President Harry S. Truman famously said, “The buck stops here”.