You want to be free. Freedom comes from changing your mindset.

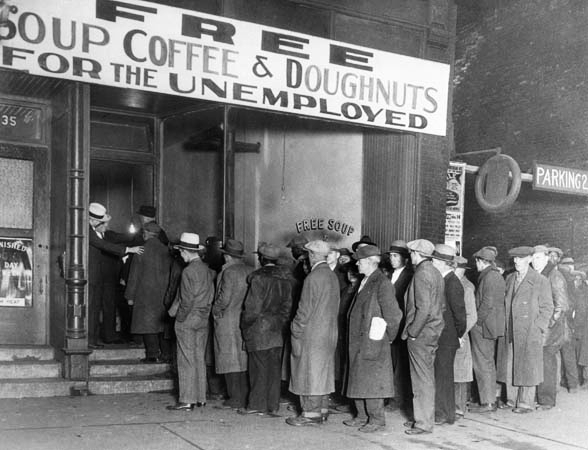

The path to true freedom takes courage. You will need to challenge much of what society, your schools, your government and your media has hypnotized you as the "Social Mantra". To break free you must put yourself first and to look to who you are and what you want to be. By learning how the bankster backed systems are enslaving you and breaking free from them, you can be wealthy, live a rich life and regain control of your time.

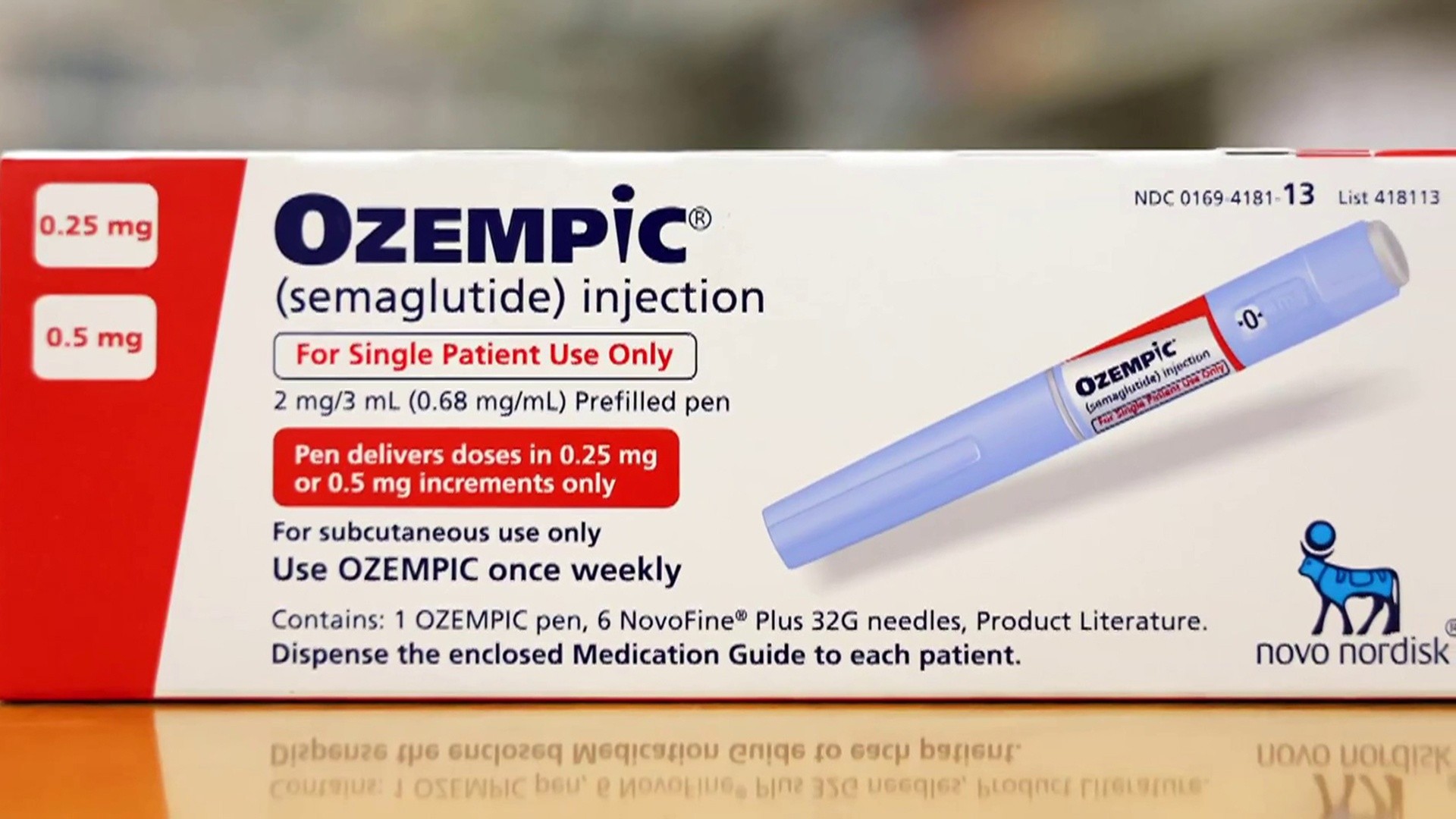

beUnconstrained.com is the story of Myles Wakeham, a contrarian, an immigrant and someone who questioned the social mantra from childhood. His stories, his discoveries, and his results are fascinating. Myles has no job, is financially independent, lives in multiple countries and pursues opportunities, projects and passion throughout the globe. If you want to learn the way contrarians think and live like this, then read Myles'

Philosophy, listen to Myles'

podcast and read his

Articles and learn how to become truly unconstrained.