Why I hate the stock market

I get a lot of flack for not showing undying love for the US stock market. The truth is that I see it more of a casino than a true market. In this article I’m going break down my reasons for my disdain at equities and why they don’t represent at all the health of the economy.

The stock market. Love it or hate it, it has made the mega-rich richer. It has made the likes of Warren Buffet one of the wealthiest men in the world. It has been the subject of countless movies and is the poster child of the US economy. When you see something in the news about the US economy, there’s a 99% chance you will get some image of the trading floor of #1 Wall Street, New York NY in the article.

So why is it then that I would hate it? Is it just my antithesis position at everything mainstream? Am I just being a contrarian just for the sake of being a contrarian? Nope. Not at all. There are factual reasons why I hate the stock market and why I am not active in it. * I'm a multi-millionaire and I've made my money without putting one dime in the stock market *

I know I am going up against 99% of the mainstream financial advisors with this, but just because equities has been the last bastion of investments that can at least keep pace with inflation, that doesn’t mean they are right. And it seems that most people fall into equities because they have little alternative choice.

Put your faith & trust in Wall Street

That’s what they will tell you. I’ve had many a lively conversation with so called “investment advisors” over this. They hate it when I disparage their idol like that. It is almost that in a world of polarization, you are either WITH the stock market, or you are WITH the terrorists. Since 9/11, Wall Street and the stock market have been the target of hate from anti-US groups worldwide, so there’s a sense of US patriotism that comes with trading on the DJIA.

But this is pure fiction. Let’s break down what the market is supposed to be, and why it has turned into an evil daemon of money.

The stock market was supposed to be a place where individuals could buy shares in companies. The companies made money by their revenue exceeding their costs, and the profits were shared out among the shareholders. Pretty simple. I mean if you want to do big things, you probably need to raise capital to do it. If you want to produce products in a factory, you need first to raise money to build the factory. One method of doing that was to do a “public offering” so that you could raise money from shareholders, who would then get a return on their shares after you started to make a profit.

I long for the good old days of a free market economy. If that was the way that the stock market worked today, I’d be one of its greatest cheerleaders. But it is far from that.

You see, the one thing that values a company is the perception of its future value. It’s like the surfer mentality that I promote - you position yourself ahead of what is coming to be swept up with it. That means simply that investing in something for the hope that its future earnings will be stellar should give you a massive gain when you see the value of the shares in that future being higher than what you bought them for. You buy, say, GE stock at $10 a share now, and in 12 months time the stock is trading at $20 a share, so you sell your shares at the $20 price, make $10 profit, pay the tax man and keep the arbitrage. Great!

But you have probably never stepped foot in a GE factory in your life. You probably know little about the company. You have never looked at their balance sheet. You don’t read their annual reports, or study their P&L statement. You couldn’t care less about GE. You might even HATE some of the things they do in the world. Maybe you hate the fact that they make weapons that kill people, or that they use sweatshop labor in some country or some other humanity reason, etc. But you still buy GE. Why? Because you can get that $10 arbitrage profit.

That’s what our stock market has become. It isn’t about business. It is a “bet it all on black” casino. The fact that GE or whatever other symbol you are investing in employ hundreds of thousands of people - people that have their own hopes & dreams, have their own mortgages and bills to pay, etc. and that they are keeping their hopes & dreams alive by providing them with a pay check is irrelevant to you. You just want the arbitrage.

But that is how it is. We accept that. In fact, the more we are distanced from it, the better for us. It is better that we just invest our money in a 401K or IRA fund for our “retirement” and leave it up to the financial experts to get us a return. If they do really well with their investments, they make money and we make money. That’s all we ask - I mean we’ve got enough on our hands getting our kids to school on time, doing the will of the boss at work, and making sure that our bills are paid. So please, Mr. Wall Street broker, make my money grow because I haven’t got the time to do this myself.

And the least I know about this, the better. I don’t care if you are investing my money in companies that are providing arms to our mortal enemies. Or companies that make highly addictive drugs that are killing our kids. Or banks that are only interested in extorting us with their loans, etc. I don’t care - just invest my money and get me a return.

But let’s put aside the arguments on ethics or morality. The stock market should still give me a return.

The stock market always goes up

Over the past few decades, we’ve been through massive swings in ups and downs in the economy. When things were great, the stock market returned well for the average investor. You might have seen as much as 20% increase in your wealth in the good times each year. Wow! That’s a lot of money. If you have saved $100,000 then you can high five yourself that 12 months later you are now worth $120,000! And these massive swings have led to continual improvements. To the point where many people who got into stock market investing were not even out of school the last time there were bad times. It is easy to get lulled into a false sense of security that no matter what happens, the stock market will go up. And up. And up.

Then you see the downside of this. Yes, half the time the market will be down. That’s just the laws of the universe. The problem here is that most folks who invest their savings into the market and see a regular increase in it, get wiped out when the market falters and crashes. And it does this about every 10 years. It is at that time, you come face to face with the dimension of time and how it can be an evil demon. If you are 60 years old, and have been working for the past 40 years and you are getting ready for retirement, you are probably watching the stock market every day. Why? Because you are about to get off the round-a-bout and you want to be sure you have a soft landing. You are going to rely on what you have invested and grown over time to sustain you for the rest of your life. You hope to live to a ripe old age, and you need your money to be there for you. And to continue to work for you.

You realize that there are risks with the stock market, so maybe you move 50% of your money into investments that are backed by governments. Bonds or Treasuries. I mean they can’t get destroyed, right? They are safe so I will be too.

But still the lure of the 20% growth in the stock market brings out the FOMO in all of us. You wonder if you are making the right choice getting your money off the table at the casino and cashing in your chips or whether you should play just another hand. I mean another hand can’t hurt, right? You won’t get wiped out, right?

Then 2020 happens. Or 2008. Or 2001. Or 1987. You can’t really predict when exactly the market will implode. But some major event occurs when the market that is based on future projected values of things decides that it got it all wrong and sheds its gains. Quickly too. Recently we saw days (multiple days) when the market lost 2,500 points each day. There are supposed to be safety triggers in place to stop it from trading if it loses 7% of value all of a sudden, but they only delay the inevitable. If the herd believe that something is worth less than it is selling for, they will cash in their chips and retreat. That’s what happened in February & March of 2020. Faced with the economic fallout of a global pandemic, all the punters left the tables and cashed in their chips. If you didn’t do this, you got REKT.

By the end of the first quarter of 2020, the entire stock market gains of the past 5 years or so were wiped out. The faith in the future was at an all time low, so the market responded. In simple terms, if there was some perception that the GE stock, for example, would not make a profit, then the future value of that stock would be lower, and consequently many got out before they had to bear the losses.

So no, the stock market doesn’t always go up. These corrections in the charts dictate a market that reflects future values.

If only it was predictable

And this is why I don’t invest in the stock market. I can absolutely embrace a market that rewards companies that invent or discover something wonderful for society. If a pharmaceutical company discover a wonder drug that cures cancer, I want to be the investor of that company before the discovery. But that makes assumptions that the underlying foundation of the market is stable.

It is not. The biggest problem is money itself. The $USD is flawed.

When I visited the Caraneggio, in Venice Italy and stood in the town square where investment banking was invented, and the site of the original pawn shops that invented the concept of lending for interest and money, I got it. I understood why this was needed and that if you have a measurement of any form, it has to be stable. The concept of the decimal system, for example, is because we have 10 fingers on our hands. Consequently the idea of “counting” is stable. We all have 10 fingers. So counting from 1 to 9 works. When you get to 10, you mark one and then count to 9 again. When you get to 19, you mark 2 and count to 9 again, etc. You get the idea. Decimal systems are the underlying foundation of mathematics.

And because they are indisputable, you can leverage that into addition, subtraction, multiplication and division. And because that is on solid ground, you can extend into equations, calculus, trigonometry, etc. And because that is on solid ground, you can apply that in building, architecture, computing, rocket science, etc. This all works because the underlying measurement system is solid. Decimal numbers. Ten fingers on your hands. Math doesn’t lie because we, as a human society, agree that 10 fingers is uniform.

Imagine if we discovered that 10 was wrong. That the entire foundation of our understanding of numbers and math was wrong. Or that it wasn’t defined by anything other than some made up fiction that someone was able to share around to the community without any form of responsibility to prove that it was right. Imagine if someone said, it should be base 16 because that is more logical. It would destroy the fabric of society and bridges would start to collapse.

Well the same is true of money. Money was a measurement of value, and has always been backed to something of limited supply. Most of the time, this has been gold. Even to this day, gold underpins the concept of valuation because it is of limited supply. If you anchor measurement to gold, you get something relatively stable. At least money would be agreed to in terms of its value as a trading commodity.

But in 1971, after years and years of war and the massive costs associated with that, President Nixon decided that money could be generated without any sound backing. The idea that the US government could borrow money from the central banks, by giving the very same central banks an edict that they didn’t need to hold gold bullion to back the issuance of currency destroyed the concept of “sound money”. It was like changing counting from base 10 to base 11. Now all the rules had changed, the US hegemony in the world was able to flex its money and devalue its debt obligations. How? It just produced more money with no backing, forcing inflation and consequently the central banks had no choice other than to raise interest rates to counter it.

This went on for years. Eventually interest rates were almost 20%. I remember watching my parents dealing with the 1970s economy where it was 18% for a mortgage. People did without back then because they couldn’t afford anything. Rather than addressing the fundamental problem that money had become detached from reality, they just started to get more brainiacs into finance to work out how to accommodate this problem rather than fix it. The bankers were still making profit on their lending, so they didn’t care. And just as you were paying 18% on loans, the banks were paying you 12% on your savings. You could double your money in 10 years. That’s good enough for a saver to retire on - in fact in today’s world, that would be incredible. At that rate, you’d never really need to worry about the risky stock market.

Time marches on

As time moves forward, the debt load is still there and no one can now put the genie back in the bottle. No politician wants to tell their constituents that they have to deal with an economy that has to return to the gold standard. They are, after all, suffering with interest rates on debt, etc. but the citizenry can get through this if they don’t take on more debt. Well that isn’t making bankers richer, so they eventually influence politicians to start to relax fiscal policy to enable them to print more money, and eventually rates start to come down and money flows. This low cost thing now called money can be released into the wild with only fractional reserves (that is you can lend 10x what you hold in deposits) so the lending starts en mass.

More lending products are invented from credit cards, to store credit loans you don’t have to pay for 12 months, to car financing, to more creating mortgage financing. All with the blessings of the politicians who just want to get re-elected.

More and more and more. Money seems to be less important than debt. Because banks make money on debt - they don’t make money on savings.

Eventually, decades and decades later, banks start to realize that by keeping interest rates at record lows, they can get the blessing of politicians who have now built up over $20 Trillion on debt and are looking down the line at $100+ Trillion in future entitlement obligations, and realize that they can’t literally afford to pay the interest on this. They have massive obligations to fund military spending and they need low rates. No effort is ever made to pay down the debt - they have become so habitually trained to borrow, that now they run their countries at a loss and fund the loss with more borrowings.

Rather than addressing the core problem, they just keep pushing it aside. Candidates for office emerge with fiscal responsibility as their fundamental policy agenda but they can’t get on the debate stage let alone have a chance of telling the story to the people. It is so complex and clouded in decades and decades of mismanagement that no one wants to hear the message.

Eventually the economy gets so backed into a corner that its options for fixing this are reduced. There are few ways they can return to “sound money”. They can only continue forward with this illusion. Those that have access to the cheap money can use it to acquire assets and service those acquisitions quickly, but those without access are left without any options. They can’t make any decent returns on their savings, so they opt to not save. The bankers can make more money with lending so they find ways to entice them into high interest products like credit cards, and they use the blessing of government officials who are literally in fear of the banks because of their massive debt loads, and eventually banking becomes an evil beast that only attempts to enslave everyone.

And that is what we have become.

What does any of this have to do with stocks?

The very same companies with their public shares rely on banks and are going along for a free ride on the same fiscal policies that government is implementing with the blessing of the bankers. Consequently when you look to the future value of a company, it is basically nothing to do with the future value of the company at all. You are betting not only on the company, but more so you are betting on the future value of money itself.

This is why when the Federal Reserve have their meetings on interest rates, etc. that it affects the stock market in massive ways. No one has any actual earnings that is real capital because that money doesn’t earn anything. The public companies trading on Wall Street exchanges elect to use the money they make as profit to buy back their own shares, reducing their ability to be taken over by their competitors and in doing this they are increasing the value of shares by decreasing the quantity of them in circulation. By doing this, the investors in those companies see their share values increase - not because the company is doing better, but because the company found a way to game the system.

This is what our stock market has become. It is a casino in which only the bankers are winning. All with the blessing of politicians and all because of the detachment from sound money that kept everyone honest. The stock market is creating “products” that are mathematical methods to game the system all the time, and that makes it harder and harder for the average investor to know what they are doing. You can’t buy into a company assuming it has a great new invention or product because you can’t trust the very $USD you are using to buy it with. And you can’t determine if the massive swings in boom & bust cycles won’t occur right at the time that you need to get the money out. God forbid, you are left without a chair when the music stops and you are 60 years old.

The stock market might go up and up and up. But the entire principle on which it is built is flawed. Some would say systemically broken. It is not surprising that you will find so many that will never invest in it. Yet the most common investors that are in the markets are in the millennial demographic who have little history with down market cycles or don’t care too much about the timing here because they don’t intend to cash out of the market for decades. They can afford the risk and when the market goes down, they just keep buying in at a discount. They are looking at a 20 or 30 year horizon here.

I can’t do that. It isn’t because of age. It is because my faith in the underpinning monetary system sees a higher than normal chance of systemic monetary reset during that time. When, I don’t know. But when it happens it will destroy the western world.

Pandemic happens

Our recent experience with this shows the flaws in this system. If you remember back five years or so, there was a nuclear disaster in Japan in Fukushima

A “never in a million year” situation occurred in which an earthquake in the ocean created a tsunami that impacted the reactors. No one planned for that level of event, but it still happened. Nature has a way to upend all human planning and it shows just how, when you least expect something, it happens.

The COVID19 pandemic of 2020 shows just how fragile our economy is. We are so habitually addicted to debt that any disruption in the income flow for the average American can destroy economies. Companies that were heavily debt loaded will not survive this. And we have not yet seen the true impact of this on earnings seasons which typically drive the future value of stocks. When the Q2 earnings reports start to come out and Wall Street sees the actual results of this pandemic, the downward spiral will open up and continue.

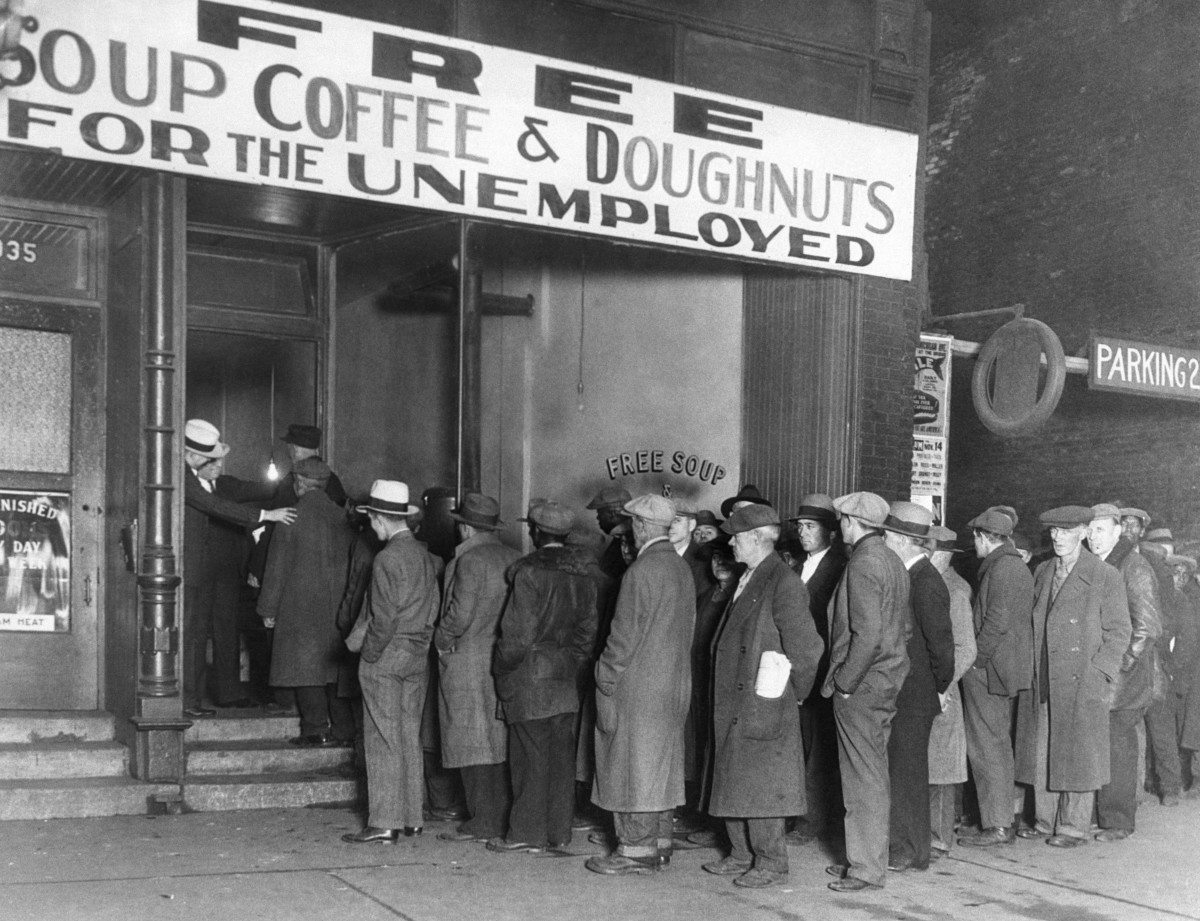

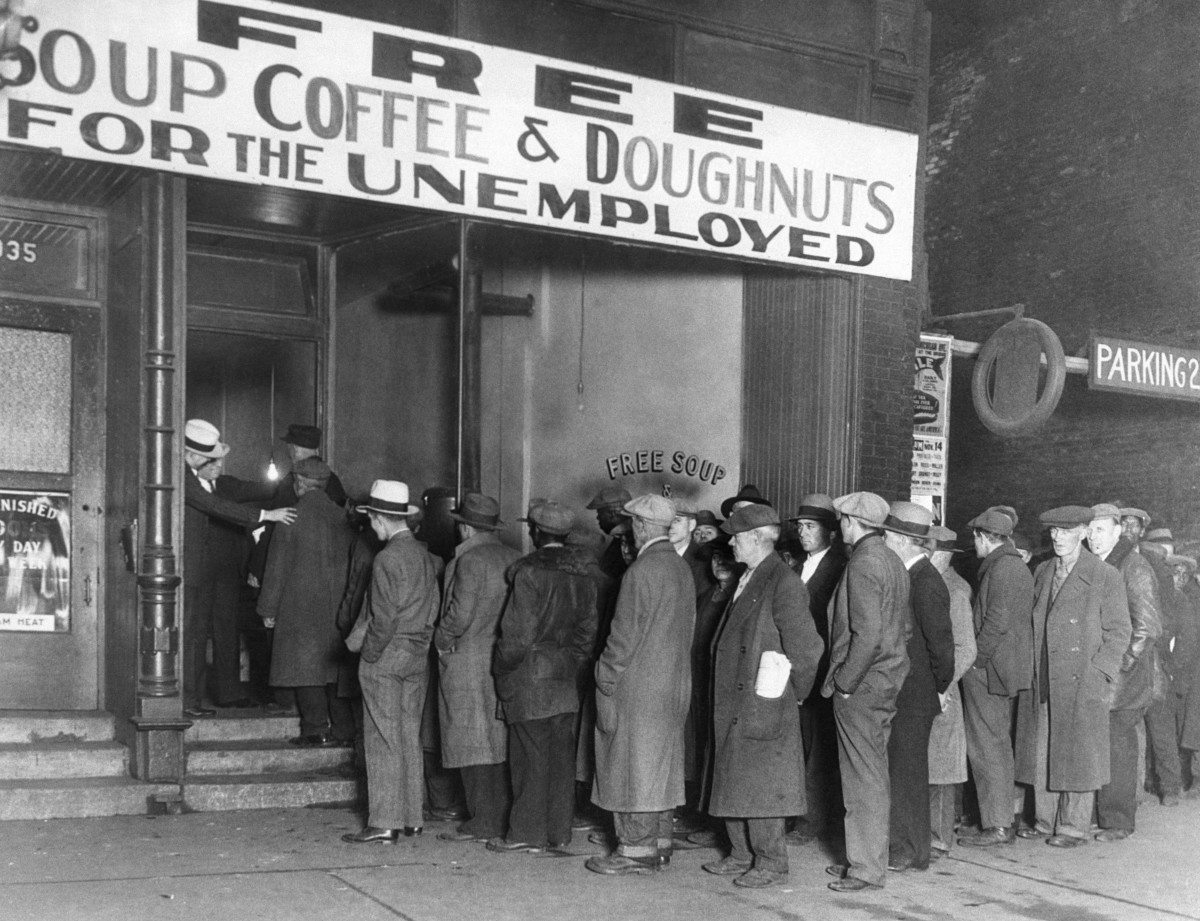

Yet through all of this, in times of the worst number of deaths and infections in modern history, we see the stock market going up. It makes even the most observant of us do a double-take on what is going on. Nothing makes sense. Yet those that have never really seen a recession or depression have no idea what is coming around the corner. We have not yet seen the impact of shutting down the economy for a few months looks like. The number of unemployment applications that are being filed are massive. 30 million and counting. The percentage of the work force that are not working, and probably won’t have a job after May 2020 is going to make the pictures of food lines in the 1930s look standard.

The reduction in tax revenue for the governments will be overwhelming as no one has a job. And the willingness of the very same government politicians to just give out trillions of dollars of money to people, no strings attached, to try and stimulate the economy and keep them from being evicted or die from lack of food, is just plain naive. But the costs of that will follow us and our kid’s generation for hundreds of years. At what point have we given up on getting back to any form of sound money? Is it possible? I don’t think so.

I think we crossed the rubicon and there is no turning back now. I’ve had conversations with smart people who believe that the path forward is more to remove money from our lives entirely, and return to socialism or even some forms of communism because there is no turning back to sound capitalism now. I really hope that isn’t the case. I really hope that there is still a future, but I don’t see it if the markets are so manipulated to be a casino in which the house always wins.

Those of us that took our savings or our winnings when the markets were bullish and put that money to work in “low Maslow’s hierachy” investments - things that support physiological needs, might stand a chance here. After all, we all need food, shelter, clothing, water, energy, transportation and communications. Those things may stand a chance of survival. But if people have to pay money for the use of those assets, I then wonder exactly what that money really gets us. If it is worthless as the paper it is printed on, then maybe finding a way to get value outside of money could be a wise move.

I’ve been saying for years that wealth doesn’t have to be measured in $USD. It can be measured in what assets you own, what food production you control, what capability you have to learn, travel, express, and barter. These things don’t necessarily need $USD. They can be done at a community level. If I have something you want, what have you got to offer to get it? If we have those conversations, we can break free of this racket entirely. Yes, it is a return to medieval times. But it works. And it will always work.

So in summary, you probably can see why I hate the stock market now. As a contrarian I see that alternative investing methods make far more sense, particularly those that are based on sound money or at least mathematics. The possible move back to a gold backed currency might be so far in the rear view mirror now, but if gold continues to offer a storage of value that cannot be manipulated, I’m all in. The same is true of Bitcoin or any other digital currency that cannot be devalued or diluted. This isn’t about some stupid “HODL” or “Moon” thing. This is about making sure that when you do eventually decide to stop working, you have something there waiting for you.

Of course those of us that follow financial sustainability don’t see any issue with this. We don’t intend to “stop working” because we were never working in the first place. Our assets did all the hard work so we didn’t have to.

Reply | Quote and reply

Reply | Quote and reply

Reply | Quote and reply

Reply | Quote and reply

Reply | Quote and reply

Reply | Quote and reply

Reply | Quote and reply