The debate over passive vs active income

Although many would attest to a debate over active vs passive income, we believe there is no debate - Passive always wins. Let's explain why.

In previous articles, I have stated that the concept of FI (Financial Independence) is flawed. Although the pursuit of it is admirable, the fact is that few FI followers have been able to do this through bear markets. Consequently putting yourself on that path has some dangers. I prefer to concept of "financial sustainability" and this article gives you tangible steps to take to achieve that.

First, let's define some terms....

OK, got that out the way. Now what does all this mean?

The concept of FI is to work extremely hard early in life, have a very high savings rate (ie. 70%) and to save that money and invest it so that you can live off the dividends of your investment. It works well in a bull market, because if you can live a life that has a low burn rate, you can survive quite comfortably with what is considered the "standard" 4% rule. This 4% rule states that as long as you don't draw down more than 4% per year of your investment, then you will be perpetually able to live financially independent and this means you have the choice to quit your job, travel, lie on a beach, etc.

The attraction of this is strong to those working a boring 9-5 job, never getting ahead and needing hope. Hope breeds a community of faith based followers, not unlike a religion and as a result, the FI movement is more cult-like than it would probably prefer.

Recently the FI movement has come under some scrutiny by long time financial pundits such as Suzie Orman. She openly critizes the movement on the basis that you would need millions and millions of dollars in savings to sustain a normal lifespan. I listened to her interview on the Paula Pant Afford Anything podcast about this, and it was interesting. I'm not sure that Suzie's point about the amount required to retire was correct - it seemed extremely high to me, but I do take her general point. The 4% rule is flawed.

This is where I sound a bit like an old fart. The majority of FI followers are millenials and most have not been through a bear market for a sustained period of time. Sure, we had the 2008 crash but that was 10 years ago. If a FI follower is 35 years old, that happened when they were 25. They likely didn't own any real estate then or investments in bonds, stocks, etc. More likely they were finishing college and just starting in the workforce. Most of those FI followers escaped the turmoil of the 2008 crash because they were not already engaged in debt, savings, etc. So to hear the "well I got through the 2008 crash" from someone aged 35 or younger, really doesn't resonate with me because they were on the sidelines during that time.

A more realistic position regarding economics come from looking at a 20 or 30 year timespan, because let's face it - we intend to live at least that number of years into the future. What can the past 20 or 30 years tell us? Well the first thing is that the universe has a nice way of self-balancing by ups and downs. Like AC power you have positive and negative energy fighting against itself to find balance. This sounds like some monk or something, but the reality is that the seasons, phases of the moon, etc. all follow the same pattern of ups and downs. And so do economic markets. They have times when everyone is positive and upbeat (bull markets) and times when everyone is pessermistic and negative (bear markets). In bull markets, companies invest in future projects, growth, etc. In bear markets, they pull back and hunker down to get through the winter.

Our economic history tells us that a "normal" cycle is about 6 years or so between bull & bear markets. In a bear markets, there are fewer jobs because companies don't want to shoulder the risk. Nor do they typically expand. Consequently they attempt to do more with less, often shaving their labor force. This has a ripple effect on the overall economy and results in other companies they trade with following suit. It also means that retuns on investments, particularly stocks, are lower. Other forms of investments become more attractive, such as bonds or real estate. However they are often closely linked to interest rates and rises in interest rates due to inflation, etc. can either strengthen or damp down those investments.

In bear markets, returns are often flat (0%) or low (1-2%). History would tell us that there would be an equal amount of bear markets than bull markets. As I write this, we are about 10 years into a bull market following the 2008 crash, which is highly unusual. Other countries, for example Australia, have had 27 years of bull market, but right now they are in a state of economic collapse as this highly unusual period comes to a close. And typically the longer the bull market, the longer the following bear market (or at least a more extreme bear market). As much as mathematicians want to hack the financial world, the reality is that the universe has a way of balancing itself.

Let's say you worked for 5 years and saved 70% of your income. You lived frugally and you amassed a good amount of income. You invested it wisely in a bull market and got 10% returns on your money. Maybe you bought some real estate and flipped it, so you bolstered that money. Let's say you have $1 million as a result of this great work.

Good for you. But 4% of that is $40K per year. Can you live on that? In what city or part of what country do you live and is that sustainable? And what if costs go up, because inflation typically happens (the US calculates about a 2% annual inflation rate as normal, so you have to factor in that your living expenses will go up over time). Many have chosen to throw away their careers and jobs to live a totally independent life based on this model, but here's the danger....

In a bear market, 4% is really hard to achieve. More likely 1-2% might be reasonable. At least without the risk of losing your basis of investing. I mean sure, if you are a savvy stock market trader you can make more money. But you risk your entire capital to do that. Most folks who are in retirement don't want that level of risk, so lower returns are innevitable. At 2% return, you are now living on $20K per year. Can you do that? Do you want to do that? How do you afford health insurance? How can you fund a car? How can you provide for a family on that?

If you saved more, you might take some pressure off. But is that possible? You have to be extremely conservative with your mathematic projections on this because most FI folk that I talk to haven't lived through a sustained bear market and everything is based on this 4% rule. Sure, over a longer time period (say 50 years), 4% might average out. But most FI followers haven't been alive that long or participated in the economy for even half of that time period.

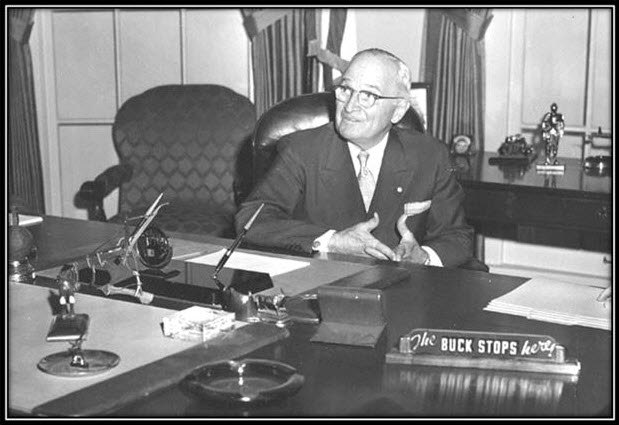

The one core risk of FI is that you put your income in the hands of a third party (investment brokers, etc.) or the market. Both of which are somewhat unpredictable. But people get caught up in this leap of faith, thinking they have no skin in the game for themselves. As President Truman famously stated, "The buck stops here".

I like to be in control of my income. That really means I don't like to rely on a third party for it. I need to know that money I make is something I have control over. So I have spent most of my life perfecting the art of risk management and learning to tend to assets in order to generate revenue. This is the core of financial sustainability.

It is not that different to a farmer tending to their crops. It requires some level of maternal care and attention, but nature has a way to grow things. The key is to have assets that generate income. I'm not talking about your home because regardless of what value you might think it is worth, you need to live in it. That means it is not an asset but more of a liability. The best definition of assets comes from Robert Kiyosaki's Rich Dad, Poor Dad book in which this is stated: "An asset as anything that puts money in your pocket. A liability is anything that takes money out of your pocket."

Those that pursue financial sustainability seek out assets that generate money. Rental real estate, saleable energy, food, shares in companies, vending machines, etc. Investments that make money when you sleep. Passive income investments that take a minimal amount of time. But not something in which you place all of your faith in a third party that could let you down. When your entire ability to sustain your very existence relies on this, you must have control. This is the only mature approach.

The first thing needed is to measure your burn rate. This is the rate you need money to survive. Frugality matters, particularly in the early days of FS (Financial Sustainability). Keep your burn rate as low as possible. This does two things:

This is no different to the path to FI. But you need to know exactly how much your burn rate is. Monthly and Yearly.

I run a spreadsheet of each month against each class of expenditure and I budget heavily. I use Quickbooks for this, and because I have multiple companies and income forms, I have to do a bit of manual handling of this, but it is not a burden. In fact it can be enjoyable. But you have to realize how much you can spend per month and aim to be well below that, because the month's will come when costs are higher (seasonal) and other months they are lower. You are looking for averages here. Budgeting matters.

Once you have established a burn rate, you can determine the base minimum you need to earn to survive. That's great information, but it should not be a part of your action plan. Because life happens. You will have adverse events and you will need to get through them. Therefore you need to establish your monthly burn rate, and then save an additional six (6) months of that burn rate in a liquid form that we can call your "emergency fund". That fund should be available to you within 7 days of requesting it, but probably best to be out of your reach for day to day use. Because if you constantly dip into your emergency fund, you will never be able to achieve sustainability.

After that, you are generating money to purchase assets. This is where you can see that you can get to this point faster if your burn rate is very low. It is the essence of work hard & save. Just amp it up. When you are younger and you have more available time & energy, directing it towards this goal is wise.

Let's remember, FS is a long term project. It is a "marathon and not a sprint". Those that reach FS, might take 10 or 20 years to get there. It takes a strong spirit and character to achieve this and the journey needs a lot of preparation. But rather than thinking of FS as a finite effort with some end point, think of it as a habit that will organically get better and better over time. And again, measuring your progress is the best way to know you are on the right path.

The thing is that you are in life for the long term. FS is just your philosophy that you carry through life. It will serve you well and it will ensure that you don't stray off the path.

OK, so here's how the actual implementation works (at least how I do it)....

I use Excel spreadsheet and I have two pages. The first is my overall income/expenditure page. I call this my "Consolidated Income Statement". I have a new one for each calendar year. Down the Y axis, I put each asset that generates money, and I track income and expenses, giving a net profit per asset. Across the top headings (the X axis), I have each month of the year, with a total at the end.

At the bottom, I total out the net of all the assets to determine actual income per month. Then I deduct any taxes that will be due on that, and I result with a "cashflow" per month. I do all of my accounting based on a cash accounting method, so I only account for actual money in hand. No projection based on checks I have not received yet. Since this information has to be a part of my tax returns, I use Quickbooks to treat each unique legal entity as a business and I link the Quickbooks company data file to the appropriate bank accounts & credit cards, etc. to automate the process of bringing down the transactions. I then use the Quickbooks Profit & Loss statements as my source documents for my spreadsheet. I also use the budgeting features of Quickbooks to allow me to work on a per entity basis for budgeted expenses. This is just normal small business accounting, but in the case of a FS approach, you will have many forms of assets and probably this will result in many business entities. At least you may choose to do that based on legal asset protection strategies or tax strategies. This is something you probably should work out with your attorney and/or accountant, and if you think that you are too small for both of these, you are probably wrong or paying too much tax or non-compliant. The costs of having a team of experts to support your journey are easily covered when you see the financial advantages that they will bring to the table (particularly if you diversify your assets internationally).

This gives me an actual picture of what is going on in my enterprise on a daily basis. Now I need to work out the "passive income" portion of it. This is where the 2nd page of the spreadsheet comes into play.

By splitting out the income lines for each entity to separate the active vs. passive income, I can feed the passive income values into a separate page on my spreadsheet that tracks the total passive income generated against my burn rate, and gives me a simple percentage. I'm looking for 100% as the goal. But I know it will take time to get there.

100% passive income to burn rate means I am 100% financially sustainable. It means that the income being generated from the assets when I sleep is enough to cover my burn rate. And if I amp that up, I can have it cover more which means I have the flexibility to increase my burn rate. If I want to go on vacation with the family, I just need to know that my passive income exceeds my burn rate, save the excess and book the tickets. And I know that while I'm traveling, my passive income continues. Eventually the passive far outstrips the burn rate, and that is when wealth really occurs.

Unlike most of our failing economies, wealth isn't about nice cars, big houses, diamonds, etc. It is simply the excess passive income above burn rate. If you are smart, you will take that wealth and re-invest it into new assets but here's the really nice thing about FS.... If you want, you can enjoy it. Because you will still be earning passive income organically. You don't have to worry anymore. If you choose to work harder on new asset projects, you can. If you choose to not do that, you can. You do you.

But if you think you are wealthy because you have a fancy car and a big house, but you are working for someone, you are fooling yourself. You are one car accident or one job loss away from poverty. Living from one extreme to the other might sound dangerous and romantic, but when it comes to money & survival it is better to watch someone else do that than to do it yourself. If you want danger and romance, go see a movie. If you want financial sustainability, pull your head in and start on the long path.

Another thing I never hear about with the FI community is cashflow. Yet cashflow is a term all small business owners understand. Cashflow is like hanging onto the tail of the dragon. You go up and down and are more likely going to be destroyed by being thrown off the tail, rather than the dragon dying on you. What I mean by this is that you need money to get through all situations, at any time. You need an emergency savings fund to act like a capacitor does in electronics - it smooths out the flow of electricity. But even sometimes the flow can be so unpredictable that most capacititors blow under the stress.

Cashflow means having access to liquid capital at any time to meet demand. When you have excess capital, you should store it. When you have a deficit, you draw down from the storage.

Most small businesses fail not due to profitability. They fail because they don't have access to working capital when they need it. To fund payroll, raw material purchases, etc. But if they are not making profits and storing that money away as available capital when they need it, they fall prey to debt which is basically the core of the problem that 21st century society have. They can't pay for the car repairs, so they put it on a credit card. Next thing you know, the credit card is maxed out and you can't afford anything because you are funding 27% intererst rates on this debt. That isn't a way to get through life, and you need a plan to get through times when cash needs are extreme. Because even the most prudent passive income investors will have times when they need more cash than expected. It is called life. Don't beat yourself up too much about it. Find a solution and work through it.

The thing is you should have skills that people will pay money for, as a buffer to get you through times when cashflow needs are higher. And that means the last thing in the world you want to do is to let your skills rot on the vine by giving up your career, etc. You want to know that in the most challenging times, you can get through it. Even if this means taking on some active income generation. Those that give up work for FI, have reduced their saleability dramatically and in a world where work is highly competitive and machines are eroding the number of labor based jobs out there, it isn't a good idea to lose your edge just so you can sit on a beach all day. That said, if you remove the stress from having to work too much and have your income generated by passive forms, then the choice to work is left with you and the additional capital you can generate can be saved to get you through the times when cashflow isn't as kind to you.

There can be a definite finish line with FS. But I would suggest to you that you shouldn't think that way.

FS should mirror life. Sure, there is a finish line in life but none of us want to get to it. The journey is the reward, and if you focus on that then you can get to FS without any real hardship. At least you have a beacon to track to, but enjoy the journey. Each day is fun and exciting and your tracking of progress should be considered a reward unto itself.

This is (again) one of the biggest flaws I see in the FI community. FI defines an end point. The end point would be quitting your job and living a financially independent life. But few FI followers have ever experienced what that means, and most who actually get there find that the end point isn't like what they thought it would be. After a few weeks of lying on the beach, what then? Are you going to stop living? Are you going to stop trying to strive to be a better person? Are you going to stop adventures? I'd say No. You will just change your focus.

FS is a much longer journey, but you can exit employment at any point along the journey and re-enter it anytime you want. The key is that you need to remove the reliance of your time being the core factor of your income. If you sell yourself short and are not generating any wealth other than expending labor for money, then you are not on the path to FS. If you are doing a bit of this, but also have some "side hustles" that are based on passive income, that's great. But it is not enough. The key is to ensure that you get to at least 50% of your burn rate is from passive income sources fast. When I say fast, I'm talking within 3-5 years. Because that will give you some form of leverage to get to the other 50%. If you have no passive income, you are doomed. Sorry, but you can save 70% of your money away and put it into a Vanguard index fund, but that won't help you when the market becomes a bear market. My specific strategy is to focus on core things that people will spend money on in either a bull or a bear market. Food, shelter & clothing for a start. Then maybe energy, communications, etc. Those things that don't get pushed aside when financial times are hard. If you focus on serving your customers in those areas, you will likely get through the bear markets unscathed.

So in the end, there isn't really a finishing line with FS. Just like you don't want there to be a finishing line with life.