Are you awake to see opportunities?

Why is it that some people have the knack to see an opportunity and seize it, and others just watch them pass by?

Although many would attest to a debate over active vs passive income, we believe there is no debate - Passive always wins. Let's explain why.

Active income represents money that you make where your time is the raw material. The easiest example of this would be when you expend time to generate income - ie. a job. You get paid either by the hour or for a mutually agreed amount of time provided (or more) for a fixed income per month (often referred to as a salary). But there are other active income means.

If you are a freelancer, you often charge clients for your work by the hour. Or if you produce a product, there is an amount of time involvement in each product that is produced. Unless this is automated by robots or a digital product in which a software robot produces it, if it requires any of your time to produce something you sell, then that is active income. Although businesses might dispute whether their income is active or passive, the reality is that if a human being has to open the business and close the business, and humans are involved in working with customers, etc. then it is active.

Passive income is money you make with no direct time involvement on your part. Now it might be that you have to invest time up front to establish the income - such as purchasing stocks or bonds to get the dividend income, or purchasing real estate before handing it over to a property manager, or buying capital equipment and setting it up to produce ongoing revenue. That is ok, because it is a finite experience. You do this once, and then you generate income. The acid test here is whether your income is being generated if you are not there, asleep, traveling abroad, in hospital, etc. If you have income that is generated in these circumstances, then it is passive income.

There is one of you. And you have a finite number of years on this planet that you will live. If you don't value your time, you are doing yourself a disservice. If you spend all of your waking hours in search of income, having to hustle all the time to survive, you can't get ahead. This is the pure definition of constrained. You cannot escape the day to day treadmill of life.

You should be able to generate income while doing this:

While you are young and have enormous untapped energy, it is easy to justify selling that time & energy to an employer. I mean it is what all your friends at college did. It is what your neighbors do. But the reality is that you won't be young & full of energy forever. The day will come when either you don't want to work, or can't work, or are too old to work, etc. that then you are completely stranded. Most people avoid thinking about the future because they feel that they have some 401k or IRA retirement plan that will be there for them in their old age. But you need about $2 million to generate an average income (adjusting returns for inflation, bull vs. bear markets, etc.). Very few people have amassed that level of retirement funds and they will be relying on funding a smaller income and supplementing it with social security from a government that is already in debt up to its eyeballs and unlikely to fund that social security payment in the future.

If you know this is the future, why are you not preparing an alternative to it? Do you want to have to take a job at 80 years old to survive? That isn't how it is supposed to work.

If all you have done in your life is focus on active income generation,then you are doomed the day you decide to stop working. This is particularly true of anyone who uses human physical labor (e.g. construction worker, factory worker, etc.) because the human body will break down over time with repetition. I know of truck drivers who have had to stop working due to chronic back pain, and lost all of their income generation. If you are in this risk category, then you better plan for your exit from that category.

With so much of the world now working online, there is less and less incentive for people to avoid active income. I mean if you make money sitting on your ass all day, isn't that the way to go? Nope. Because you will likely be automated out of a job. Automated Call Attendant systems put phone operators out of business. Web sites put call centers out of business. Amazon's robots put warehouse workers out of business. The more that you hide the core income generating systems behind web sites, etc. the more likely the owner of that business will outsource the work to a third world country or will replace you with software. Their customers may never see the difference, but you will. Online workers are a temporary fix to an automation redundancy that will come as the technology improves. And with "Moore's Law" dictating that all technology doubles in power every 18 months for the same price, the writing is on the wall if you rely on expending labor on a computer to make money.

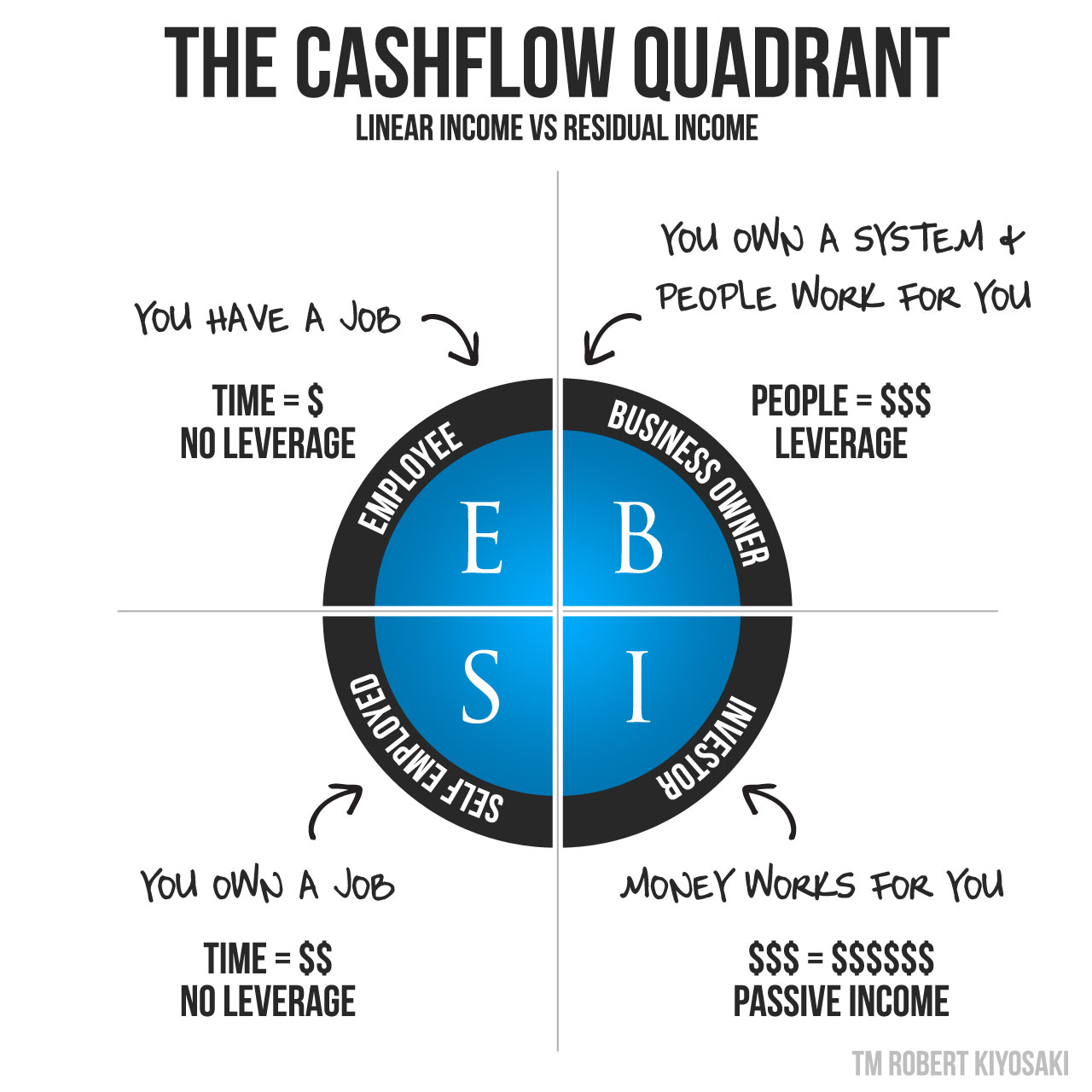

Robert Kiyosaki, the author of Rich Dad, Poor Dad, defined this perfectly and the definition works as well today and in the future as it has in the past.

The four quadrants of income represent a worst to best case scenario. Starting with the E (Employee) quadrant, this is where you have a job and are submissive to a boss. The S (Self-Employed) quadrant is where you go out on your own, but in doing so you now have many bosses and are submissive to them. In the B quadrant (Business Owner), you own a business that generates income relying on employees, and although they are replaceable you are still submissive to the customers & employees to generate income. In the final quadrant (Investor), you own assets and those assets generate you income and wealth. This is your goal. This should be your end point.

It is not to say that you have to traverse through each quadrant. I know many people who have gone from E to I directly. Those that save most of what they earn in a job, and invest it (the FIRE community - Financial Independence Retire Early) often fall into that category. The problem is that by not traversing through the quadrants, there is no education or experience gained in each sector and that usually leads to the "Fool & their money are easily parted" situation. If you invest in some Wall Street Money Market, mutual fund, indexed funds, etc. you are giving up control of your money to a third party who doesn't necessarily have your best interests at heart. This is often the way that the FIRE community get into so much trouble. By focusing on a life living on the beach, and giving up control of their assets to a third party, they are relying on a 4% dividend to survive and when that doesn't happen, they have no recourse to generate money. Sure, you could go back to work but are you competitive now? If you have been out of the workforce for a period of time, do you think that employers will want you back in? Are you able to compete for the work with other employees who are more up to speed than you, or worse - with a robot that clearly doesn't come with the risk of quitting their job once they make enough money to cover the shortfall and going back to the beach again? Employers don't want you if you fall into those categories.

You need to purchase assets. It is that simple. First you have to be able to define what a passive income asset is. It is anything that generates income repetitively that doesn't involve your time to directly get that income. There might be a small amount of your time required to tend to the asset. A simple example of that might be a vending machine.

You have to stock it with products, and you have to collect the coins and then re-stock it again. That is active time involvement. But if you have some form of vending machine that only requires you to do that once a month, then you may have a good passive income opportunity. An ATM might be like that. Or a coin operated laundromat. Or a video game arcade machine. It depends on the machine. But if you can make $500 of profit every 2 weeks or so collecting coins, stocking up the machine, etc. and that takes you 1-2 hours of labor for every 2 weeks, that is a hell of a lot better than working 40 hours a week for an employer. I mean you can scale that business too. You can install 20 vending machines, and maybe leverage your time so that one day of work per two weeks = $3,000 of income. Sure, you will probably have to do some income sharing agreement with the owner of the property where you want to install the machine, but still isn't it better to generate $1500 every two weeks for one day of work?

Other assets may be more expensive to purchase. Real estate for rental income is probably the most lucrative form of passive income. You can rent out the property to tenants and take their rent and pay off a mortgage with it, eventually owning the asset outright. Or if you have enough cash to purchase a property outright, then all the rental income you can generate is yours (less any costs associated with running the building, such as insurance, property taxes, management fees, maintenance, etc.). Each building in each location is going to be different - some will geneate high rental income and others won't. You have to do your research, but again, it is passive income while you have tenants in there. And the asset typically goes up in value, so if you ever decide to sell it, you probably will have more to show for your capital investment that way than other purchases.

Another passive income idea might be to invest in storage units. If you rent out storage units to tenants, then they require little maintenance and typically can be purchased in lower priced areas. Most people who store excessive stuff, don't care if they store it out of town as long as they can get to it each month. They accept that their bank account will be debited for storage fees each month and they don't care. They just pay it, and you get that continual passive income stream for something that basically they maintain.

Other passive income ideas could be Wall Street products like stocks & bonds, mutual funds, Forex trading, Gold & precious metals, crypto-currencies, etc. They are all passive in that once you acquire them, you are able to generate income (hopefully) by their increasing in value. These areas require more risk and often do require active attention, but not active labor expenditure to generate the income.

Passive income takes a LONG time to settle in and generate money. That means the earlier you start, the faster you will get some yield on this. It is like planting crops. You don't really know whether you wil be subject to bad weather, etc. but you hope for a harvest at some point. Passive investors are long term thinkers and they are patient. They don't expect to quit their jobs immediately - they get a lot of diversification and a lot of different income forms before they see a track record of income that they feel is enough to convert all of their income over to passive. But with each amount of income that starts to trickle in, it takes off pressure from active income participation where eventually it becomes a choice YOU have and not a choice that is made for you.

So don't expect to start the journey towards passive income and get immediate benefit. It could take 5, 10 or 20 years. But if you know the future of YOU and your physical biology, isn't it a wise move to start something now? At least start the research and know the Cashflow Quadrant and the acid test of what is a true passive income opportunity rather than being forced to work until you are old and never really get to maximize the use of your time?

I get a lot of people saying, "But I like my job. Why would I want to stop doing it?". To that I ask, "Do you really like your job, or are you comfortable with accepting your job?". Is it that your job defines who you are, rather than you defining who you are? If you won the lottery tomorrow, would you quit your job or continue to be subjected to the harrassment and submissive behavior requirements that most jobs have these days? Would you eventually quit because you didn't need it anymore?

And what would you do with all your free time now? You know that is a question your 16 year old self probably had to answer and chances are that you took a path pre-ordained for you rather than making that decision back then. Well guess what.... Now you have some life experience. You can probably answer the question, "What do I want to be when I grow up?" with some context of how the world works that you didn't have at 16 years old. I'd say you are in a far greater position to successfully answer that question now, especially if you don't have the day to day stress of making money over your head all the time.