Detaching from the Matrix…Small steps to big rewards

We are in a mess. We got this way because people forgot that the power brokers of the world treat life like a chess game, and we think of life like a daily or hourly experience.

I wanted to single out two schools of thought when it comes to money. Those that pursue being rich, and those that pursue being financially sustainable. Both share the same goal of being financially free, but often the road to get there is very different. In this article I want to discuss these two strategies, and let you decide what path is best for you.

We all share something in common - the need to be free. We were born that way, only relying on our parents to provide safe haven for us when we were at our most vulnerable state. But after we found our wings, we were expected to leave the nest and pursue a life.

All around us we see the trappings of wealth. Fancy cars, nice houses, the latest gadgets, malls, etc. These speak so loudly in the western world that they drown out any other conversation. The billboard signs on the side of the road that tell you that you can have it all, if you only get the AMEX Platinum card or some such alternative, broadcast the propaganda of the corporation. They seek to trigger your inner emotion of what you desire, and most fall prey to it.

Meanwhile you quickly come face to face with the reality that the rest of the population expects you to pay your way - your rent, your health care, your food, your clothing, your phone bill, Internet, power, etc. They all seem to have their hands out wanting your hard earned money. This cycle repeats every month. The bills are due and it all falls on your shoulders.

But on your way to work each day, that same billboard sign beckons you. “Escape the rat race”, “Become rich beyond your wildest dreams”, etc. and in our media they celebrate the mega wealthy who took a risk and got a reward. The Steve Jobs, Elon Musks, Warren Buffet, etc. They become the social heros that help drive us to try and do more, earn more, be more.

However are we happier? Do we ever question that commute to work, passing that billboard sign, and realizing that this cycle never ends? That the more we fall prey to the promoted product of the day - following some groupthink towards our utopia - we lose a little of our identity everyday. Many try to use their work as their identity. They call themselves a “plumber”, or a “customer service manager”, or a “programmer”, or a “banker”, etc. When they meet others, the first thing that is used to try and identify the individual is the answer to the question, “What do you do?”. This is how our modern society tries to identify the integrity of the person. Make a low income, and you are not considered “there yet” or that you are a “loser”. Make a high income, and all the people flock to you - seeking out your shelter from their financial winters. That includes your governance and leadership who feel that you can bear the burden of paying for the costs of empire and society more than others.

But the answer to happiness is often pushed aside while the distractions of maintaining and pursuing the obligations of our social contract take center stage. And repeat, over and over and over again.

So how do you try and find your freedom in this sea of distractions? Well if you follow what the roadside signs will tell you, you would want to be rich. You want the Ferrari lifestyle, private jets, champagne in Monaco, 5 star lifestyle. That’s where you find a following of people that will circle around you - looking for your charity and shelter for their own financial freedom.

Maybe you try and find a less aggressive path towards freedom. The idea that if you focus on those cycling bills each month, and find a way that you can cover them without selling your soul, that this is enough.

Which is right? That’s the question that only you can answer for yourself.

What is something that this article is discussing is the definition of “freedom”. This is the ultimate goal of the individual regardless of the methodology that one takes to get there. Freedom simply means that you are not subservient to any third party, individual or doctrine that restricts what you can do with your time. We understand that time is a finite resource, and must be cherished and nurtured.

First, let’s make some definitions:

The idea of rich is that you have an excess of money that allows you to not only cover your burn rate, but have a significant additional store of wealth. That store of wealth is often used for audacious or luxury purchases - things that promote wealth to your circle. Whether they be friends, acquaintances, or people you just don’t know. As humans we crave some form of attention, and wealth is one of the greatest advertising slogans to gain that attention. This is why many of the rich are tactless promoters of themselves to try and garner attention from those that wish to use them as a poster-child for what they don’t have, and desire.

That might sound like being rich is a bad thing. It is not. Being rich in which you have security, and the freedom to live life on your terms, never having to worry about money ever again, etc. is what we all crave. Unfortunately if you look at the majority of the rich, they spend most of their time focusing on money. Whereas those who don’t classify themselves as rich are forced to spend their time focusing on money in order to get through the monthly cycle of bills, etc. the rich focus on it to acquire more wealth, even though their base level needs are already easily met.

In this context, the rich raise the level of “lifestyle inflation” to meet their income, as their income seems to see no bounds. They want more, more and more, yet often don’t realize that more doesn’t make them happier. But like all things about identity, they have identified with being rich and sold that to their following, so they must maintain the facade of wealth - both to themselves but also to their social support system.

To them, money begets money. But in reality they become more and more of a target of the criminals and extortion experts that want to seize wealth. They are criticized by many that they don’t deserve it, or they have too much. They are the “1%” that own 99% of the wealth of the world, and income disparity is the main reason why everyone else got a shitty hand dealt to them, yet the mega-rich don’t pay their fair share to society.

To shield themselves from this criticism, they retreat to heavily guarded mansions and employ an army of lawyers, tax attorneys, private security, etc. so they can maintain this audacious life, but further remove themselves from their circle. They might find that the missing social link here is met with fame, so they continue to pursue that. They want to be interviewed on Bloomberg or CNBC, and they want to be the answer to the social question of “How do I become rich?”.

This is not to say that all of those that pursue and find wealth are like this. But this is what we, as a society, portray them to be. Those that don’t advertise their wealth and don’t seek out recognition or validation from society for their success, may be the ideal point of focus for those that want to be rich. The problem is that they are not publicly obvious and therefore disappear from focus from the average person. Since they are the invisible wealthy, they are rarely celebrated, or wish to avoid celebration or scrutiny. So there are different forms of the rich - those that seek out validation for being rich, and those that actively avoid it.

There is one thing that seems to be in common regardless of the style that one seeking richness has - a quest to acquire a high net worth. This is easily identified by the concept of a “balance sheet” in accounting - that is, one’s assets, less one’s liabilities, equals net worth. The higher the number, the richer they are. And since assets & liabilities are often subjective in terms of their value (as asset value is really a perception of value), we have to look to generally accepted measurements of this and often those measurements are “best guess” types. For example, real estate value is really based on “comps” of what others in the general area have valued something at, when they sold it. The higher the price target on property, the more that number varies. If there are many single family homes worth $250K, for example, it is easier to define a value. If there are less $25 million mansions, it is harder to know what the true value of the mansion is. It is all based on price discovery or what a buyer is willing to pay for it. Therefore the richest among us may have some difficulty identifying a net worth amount, since their asset values are highly speculative and also high priced asset valuations are more likely to plummet in times of reduced liquidity or smaller market to sell the asset in.

The pursuit of more and more wealth therefore becomes more nebulous over time. However if the rich can create a path for others to generate income, they serve our society in such a way that helps everyone rise up. And for that reason, you can never be critical of those that are creating a path by their actions for the rest. The rich should not be criticized if they are actively involved in seeking out a solution to a problem and creating a path for others around them. For this reason, they are worthy of celebration.

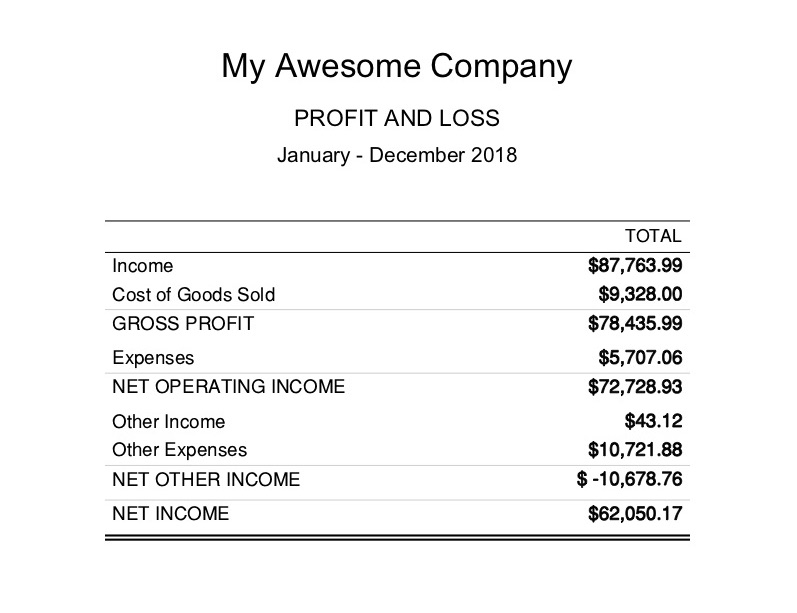

FS is more of a bottom up approach to wealth. What I mean by this is that financially rich is top down. I’m talking about a profit & loss statement there. Financially rich focuses on growing income. The more income, the more control. Increasing sales, increasing volume, “go big or go home” kinda attitude. Scaling the endeavor, the venture or the individual in order to make more money. Since a single person, spending their time in working, can do only as much as the output of the hours that they commit to their task, FR often means creating an organization of individuals that can work en mass to increase wealth.

FS is the opposite approach. Rather than focusing on income, one focuses on expenses. This requires some form of clarification - one must really understand what a Profit & Loss statement is, and how it is read. This is a universally accepted means of defining profit or loss, from an accounting point of view. Simply put, it is income less cost of goods sold, and that gives Gross Profit. The bottom-line of this establishment is Net Profit, which is Gross Profit less expenses. The report is for a time period (ie. a month), so a simple example might be a self-employed plumber. They do work that generates $5,000 of revenue (income). They spend $1,000 on parts for that work, like pipes, etc. leaving them with $4,000 of Gross Profit. But in order to have an enterprise, the plumber must pay for their vehicle costs, their insurance, costs of other labor (employees), costs of licensing, costs of communications, marketing, etc. and those costs exist regardless of whether the plumber does any work or not. If the monthly costs to run their business is $3,000, and we deduct this from Gross Profit, we are left with $1,000 of net profit.

The plumber might live in the illusion that they are making $5,000 a month. The reality is that they are making $1,000, as they are neglecting to recognize and measure all the costs associated with their venture. In many cases, so many of us don’t recognize those costs correctly and actually end up with a loss at the end of the period. To fund that loss, we go to the rich to borrow money, on the proviso that we will change our behavior and realize a profit and that the profit can pay back the loan. This never ending cycle becomes the #1 reason that most people don’t get ahead - don’t break free of the enslavement to work and selling their time for money, and often it is simply because they don’t measure costs, and they don’t realize how much they are paying for things they don’t need and they don’t look critically at their life and adjust it. Rather they are looking at the billboard on the way to work and wanting to be rich - to break free of these shackles, yet the true answer to break free of it remains simply in them coming to grips with their expenses and being a critical thinker about how they can get what they need without losing money to get it.

By focusing on the expenses, which is the core first part of financial sustainability, one can reduce one’s “burn rate” to a minimum, so that they are not required to generate a lot of income to get their freedom back. This bottom-up approach is something that every individual has the power to enact today - it doesn’t require some startup capital, risk taking and business acumen to achieve. It can be done with little or no business experience, but one has to be willing to look at their decisions and behavior critically in the mirror. Many have issues with that, because no one wants to come face to face with failed decisions or habits that they make in life. Yet each day we neglect to do this, we become distanced from the reality of our pursuit of freedom. Financial sustainability is the attempt to regain control here.

However there is more to this. If one has one’s “burn rate” down to a bare minimum, then they have many more options on generating income. They could do this through a variety of means, and since it is next to impossible to have $0 expenses in the western world, we must all realize that the burden to generate any income is upon us all. You can choose to be FR and make millions, or you can choose to be FS and just exceed your burn rate. Either is an acceptable strategy.

The missing link in FS is finding a way to make the income required without having to sell time to do it. We call that “Smart Income”. Smart income (often mis-represented as Passive Income), takes different forms - the more the merrier, and in the 21st century, we attempt to use automation and technology to generate some of this, and more time tested methods of meeting social supply/demand needs with other parts of it. If you can take your efforts and invest them into acquiring assets that generate you smart income, and that you track this as closely as you track your burn rate, you can find a way to get freedom back.

Once you achieve a position where 150% of your burn rate is covered by smart income, you are financially sustainable. This is far more achievable that most other methods, because it doesn’t require that you generate incomes in excess of millions that the FR approach would follow. It is also the antithesis of the billboard on the roadside that you pass on your way to work, because it won’t sell you the glitz & glamor of the lifestyle of the rich and famous. It is a boring, conservative and basic approach to self-reliance and independence. Yet it is far more achievable that most ventures that fail 9 out of 10 times.

If one is generating smart income by way of rental real estate, websites, vending machines, residual income streams from revenue sharing programs, etc. then one can achieve this quickly. However if one wishes to pivot from FS to FR, that’s certainly possible. There is no reason to stop creating more smart income streams and if you are well exceeding your burn rate, you can up your expenses as needed to still be within the 150% ratio. Risk taking can be done at that point because as long as you don’t risk the 150% ratio, you are free to do whatever you want with your time & money. And that’s truly freedom.

That’s a question only you can decide for yourself. Any option outside of this is likely to be the antithesis of freedom. And 99% of society are not following a path of FR or FS. They are just selling their time to a boss or company, losing their freedoms and choices and living pay check to pay check, most never having enough money each month, and their personal profit & loss statement would show a loss month on month.

They bolster that loss with credit card debt, and they use their homes as an ATM machine to extract equity under the false pretense that a little more debt is just fine - we can handle it. Interest rates are low and we can refinance ourselves out of it. They participate in title loans, pay day loans, etc. to find ways to reduce the loss rather than taking a critical look at their burn rate.

And meanwhile they still have the same waking hours on this earth as anyone participating in FR or FS has. They, however, use that time to welcome distraction. It is a welcomed means to take away the pain of their demise. Spending hours and hours on a smart phone looking for social validation or likes is better than critical analysis of their expenses. Same is true of television or other forms of escapism. Many turn to extreme escapism such as alcohol, drugs, nicotine, and gambling. Many turn to food and become obese, and many use “retail therapy” as a way to try and find happiness - only to further dig themselves into a hole.

These are the 78% that Forbes Magazine call the “pay check to pay check” folks. And since the ongoing mistakes can often take years before they are fully realized, the same folks can’t retire at some senior age, where statistics will tell us that 80% of American workers have no chance to retire from work at any age, and will likely keep working until the day they die.

This is a social problem. It is a problem we all share, because we are our brother’s keepers. We are responsible for the health & well-being of all of us. We don’t walk down the street and step over those that need our help. Yet this is how many have to operate - pretending away the societal problems that surround us, as they are too busy to help - they have to get to work, they have deadlines, etc. and meanwhile they are not doing what is needed to regain their time & focus.

Only you can choose the right path through the maze out of this mess. You should, however, start that process today. You should think about what your strategy will be. Do you want to be embrace business and create something awesome and make billions with it? Do you want a simpler path of FS and just get back your time again so that you have choices? Or do you want to pretend this all away, and lose hope in finding a path that is meaningful?

You must be the author of your own story. It doesn’t stop when you no longer have to work, however. That’s just the beginning. You must find a path that you embrace and are passionate about and the worst crime here is that you sell out your future too early before you have the time & energy to begin that search. No, you have not “won” at some young age when you retire early. And you have not “won” by not having control of knowledge of your burn rate numbers and monitoring this regularly. And you have not “lost” if you find yourself in the majority here - those in the pay check to pay check category. You are a success story about to happen. But you have to take the first step to start that process.

The true winning formula here is to have the freedom to pursue a path in your life that helps you learn about yourself - your strengths you don’t know about, your weaknesses that need some attention. Like an athlete, you don’t just become strong. It takes time, discipline and repetition, and that is the core principals of FS. Patience to obtain the things you need that will last for the rest of your life.

FR may also embrace similar principals, but it adds a level of risk into the process that may be something that is a bridge too far for many. We each have a tolerance level of risk - yet we must also agree that there is no progress forward without some risk. Those that tell me that they are taking a path of 0 risk, are fooling themselves. All around them are car accidents waiting to happen, divorces looming, health events they have no control over, parents, siblings, spouses or children that they are responsible for that may fall prey to the very same risks. There is no way to live a life without risk, and yet learning to dance with the risk yields often the best returns - whether that is financial or experience. Tell that to anyone who is a skydiver.

The balance between FR and FS can be found if you are willing to first achieve FS. The adventure never stops once you no longer have to do anything to earn money. It is just beginning.