The debate over passive vs active income

Although many would attest to a debate over active vs passive income, we believe there is no debate - Passive always wins. Let's explain why.

First, don't panic. Don't get depressed and don't think all is lost. It isn't. We will break down the fallacy of retirement and turn some lemons into lemonade. There are ways to sustain yourself financially and it doesn't require millions of dollars in an index fund.

There's a socially accepted definition of life that we get taught early, and go on living with throughout our years. I am still trying to find the genesis of this idea, but it is proliferated by governments, economists and banks and yet still I don't really know why. The idea is that you spend the first quarter of your life learning to be an adult and have some skills to offer the world, the next half of your life working tirelessly to build a family, house, security, etc. and the last quarter of your life not working, as your body slowly degrades eventually ending in death.

Wow, when I explain it like that it sounds pretty sad. Well what if I was to tell you that the whole thing is flawed and maybe it is time to rethink the traditional life. And that you can start at any time with changing this paradigm.

I know I'll get flack for saying this because when you question someone's well held belief system, you better be prepared to defend your statements. OK, I'm good with that. There are some critical flaws in the education, work, retirement paradigm. Here's a few of them:

Now let's apply each one of these flaws to each segment of life and how each segment has to adjust

We have created this horrible cartel of banking and education that has driven up education costs, particularly in tertiary education, to the point where the majority of students will graduate with a diploma and a mortgage. Many will be working for 10-20 years to pay that off, depending on how much debt they took on. All because society told them that in order to enter the middle class they needed a permission slip - a Bachelor's degree. In fact these days, many bachelors degrees are basically the equivalent of a high school diploma of 20 years ago, in that they don't release a student into the "real world" with any preparation for it. The exception may be "hard degrees" based on hard sciences, like medicine, engineering, law, architecture, accounting, etc. Those degrees typically require at least a graduate degree to have any value in the workforce meaning that (again) the colleges are using the first couple of years of tertiary education not focused on learning anything but just adjusting to the world of the university.

When the student is released into the workforce, they are now competing for job opportunities with seasoned, experienced employees and machine automation. Corporate management prefer machines over humans because machines don't need days off, work 24 hours a day, don't organize and don't require constant motivation and healthcare.

Due to the competition from automation and corporations left to "go rogue" with employment methods that disallow trade unions and run loose with labor laws on things like how many hours a week a worker is expected to work (vs. how many they are paid for), along with reduced annual vacation & sick days, etc., employees don't have a really nice lifestyle to look forward to. Whereas the past respected a worker's time after 5PM, today they are on call 24 hours a day, and even though they will never admit to that expectation, the corporation have ways of dealing with whistle blowers.

Buying a home is the most likely largest expense a working family will have, but with the rising cost of real estate - particularly in urban areas, and the debt load that the young family have with student loan debt, means that often they delay the purchase of a home if they even choose to do that at all. A delayed entry to the "property ladder" means that there are less years ahead to pay off the home, requiring more work to fund the mortgage. The resulting wealth increase can be delayed by as much as 10 years, meaning that fewer families ever actually get to pay off their mortgage at all before the time that their work career ends due to the natural end point in one's working life.

Additionally the wages are reduced as automation affects the supply & demand curve that determines wages. An interesting discussion about this was featured on Cedric Dahl's "Internet Money" channel on YouTube that speaks to this dynamic:

Meanwhile the cost of resources will constantly be increasing due to monetary policy devaluing the $USD. Since this is the cornerstone of the world currency, as it reduces its efficacy, it will mean you need more $ to buy stuff. Your need for stuff never goes away, hence your need for more and more $ is maintained. Meanwhile the supply/demand curve means you have to work 2 jobs to make the same spendable income, and there are no longer 2 jobs available. Pretty sad state of affairs, but those that have surplus capital will be fewer and fewer, and those that have that surplus capital may be able to put some of this into retirement savings, but unless your country enacts some forced retirement savings plan by employers (ie. the Australian Superannuation plan), there won't be enough saved and the promise on govt to pay out social security for seniors will be unlikely to be kept.

Whereas a lot of those that don't have enough saved up for retirement are expecting to work well into their 70s, they are making the assumption that there will be work for those of that age. Since they are unable to do heaviy labor at that age, most other jobs that they could fit into would likely be replaced with a robot. As much as I want to see the nice old man as the greeter at Walmart, the fact is it is a superfluous position, and one that could be eliminated or replaced with a Google Voice bot. Sounds horrible, I agree. But the options are drying up.

Additionally those that put their savings into investment products run the risk that those products don't collapse in an economic recession/depression. The "boom/bust" extremes have been with us for about 30 years now, and these days it seems we forget how much we all hated seeing things go into bubble territory and then burst, covering us all with the debris of past greed cycles, because no one wanted to be the adult in the room and tell the bad Wall Street greed barons to back off. Administrations that reduce regulations are applauded for this, until something goes wrong and a bad drug enters the market or an economic collapse occurs. Under their watch. But we forget that the regulators dropped the ball. We just accept this as normal. That's the biggest flaw.

So if you put your investments into anything you don't control, then you run the risk of being left without a chair when the music stops. This is what happened to Dot Com investments in the 2001 period, or real estate investments in 2007. What is the next boom/bust cycle? You know one is coming, but what is it? Is it possibly that over-inflated stock market? And where exactly are your investments put right now to get growth for your retirement? Could it be the DJIA? Hmmmm....

Here's some light at the end of the tunnel for you. First let's get the basic context out of the way behind my theories.

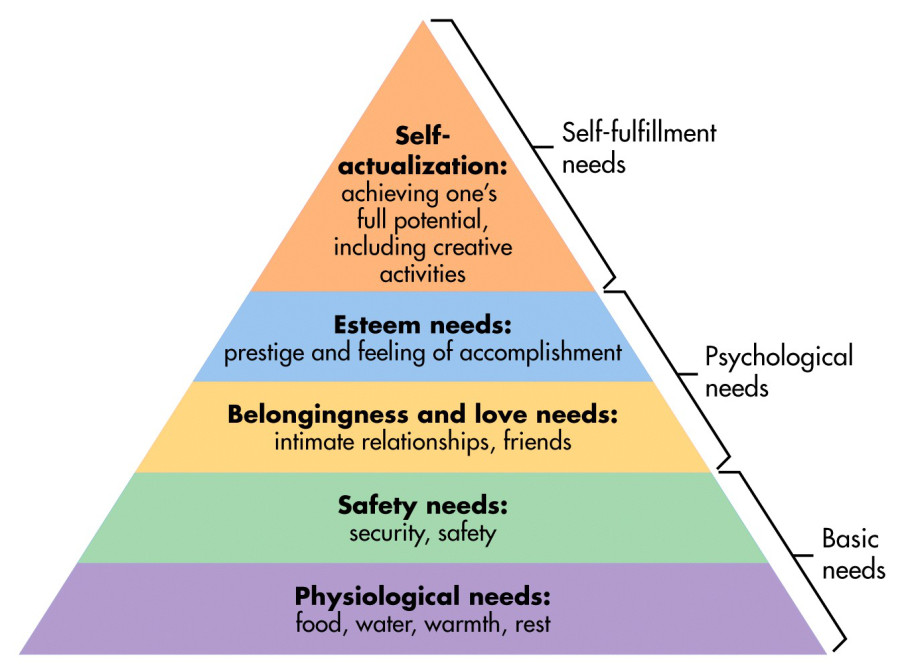

There is one thing in life that is an absolute truth - you need money to survive. You consume things because the human body requires it. We consume food & water to exist. We wear clothes to protect us from the elements of weather and we need shelter to provide us with a place to exist, sleep and thrive. These are the cornerstones of basic human existence. The best way to visualize this is with Maslow's Hierachy of Needs:

Starting at the bottom, we strive to fulfill our physiological needs (food, water, clothing, etc.). Once this is fulfilled, we advance up the pyramid to safety, then psychological needs, and finally self-fulfillment needs. An idea life based on this paradigm is that you move up the pyramid over time - over the course of your life, with your final quarter spent in the uppermost sections of the triangle. But we don't do we.

What we actually do is to assume we are entitled to the upper levels early in life, often at the expense of the lower. When that happens, you don't have enough money to pay the necessities because you spent your money on the latest X-Box. That's a dangerous problem. If you held back on your self-fulfillment needs, and only addressed them after you had all the basic needs taken care of, then fair enough. But society doesn't do that. That's why Pay Day and Title Loan services exist. That high interest, quick fix solution to what is normally bad decision making that goes against Maslow's hierachy.

So here's the solution.... Spend as much time in your life in not being burdened by the things that you would be best dealing with later, and live frugally as early as possible, meanwhile working hard and saving. That's the first step. Get yourself as self-sufficient as possible, like a bear getting ready for a long winter. Because you know winter is coming.

The first thing we need to do is measure our burn rate, with the goal to keep it as low as possible. Once you know this magic number, you have the keys to the kingdom to live & retire. Because you just need to meet (and ideally exceed) that burn rate.

You need to know what your total monthly budget is, and you need to be able to seriously look at each expense and categorize it as:

And be blatantly honest in how you categorize it. Think as if you lost your job, and you had to make some hard cuts. Optional goes first, ideal second and you can't cut essential because they will impact your ability to survive. If you cut the optional now, then maybe you will find a way to save more money, and therefore have some form of emergency savings fund to allow you to keep going in turbulent times.

In electronics, there is this thing called a "capacitor". Your emergency savings fund is kinda like a capacitor. It smoothes out the flow of money going through your home economics so that you can whether the storms that will come. And they will come. So in order to build up that safety net, you need to be saving as much as you can.

But this is where the fallacy kicks in....

With a low burn rate, you have the power to control decisions better. You are not forced to work because your bank tells you they want the mortgage payment or the student loan payment or the car payment, etc. Because you chose either not to have those things, or you paid them off as early as possible. This is just prudent practice. But what if you had a low burn rate that you would be completely happy to retire on, armed with some savings to get you through the turbulence?

If your burn rate is $3,000 a month, you need an income source that doesn't require you to generate it. And that income source has to adjust upwards for inflation. An income source that you have control over, and that you don't rely on greedy criminals to provide to you.

So what meets that criteria? That, my friend, is your mission. Find a passive income source that you have control over, that you don't mind attending to, and you can generate surplus cashflow from. Likely you will need many of them, but the goal is that they don't require labor to maintain. Let's look at two of them that you can begin to acquire early, and that grow organically in value. There are many others, but the mission is for you to find those that meet your criteria now and that will grow over time.

The markup on beverage vending or candy or laundry or any other product that can be provided by machines are huge. And since we are living in a world that automation is growing, isn't this a great way to participate? What do you need to get started? You need a machine, you need a location to put it, and you need to stock it with supplies. Then you collect the coins from it periodically and bank the profit. The key is choosing what makes sense for you, and there are many, many options here. Vending machines are not too expensive to get started and there is an active used machine marketplace out there that will let you get started quickly. You may need to share the profits with the location owner where you put it, but there is still huge margins here. A can of coke if purchased in bulk quantity at Costco is about $0.33 a can (I checked this at the time of writing, but you might want to check it before you purchase). Resale price on those are normally about $1.25-$2.00, which is a huge margin of at least $1 per can. Let's say averages at $1.25 per can profit, and you sell 50 cans a week. That's probably conservative depending on where you locate the machine, but if you split profit 50/50 with the location owner, that's about $31.25 per week profit. That's $125 a month, per machine. Let's say you have 5 machines. $625 profit per month. It takes not much more effort to collect and stock 5 machines as it does to do one. You still have to visit Costco and get the stock, you still have to travel to re-stock and collect coins, you still have to go to the bank to deposit the coins. It is a highly scalable business you could run 20 machines in 1 day a week if you wanted.

Depending how much effort you want to put into this, you could run high margin AirBnB style rentals of property, or longer term residentual leasing. It costs more to get into this business, but the returns come from either cashflow (the profit you make from rents collected less costs, incl. mortgage, repairs, insurances, taxes, etc.). You have to be willing to work with people and this is why this business typically works better for those who are more "people people". But the profits are not just in the cashflow per month, but in the equity growth of the property values.

And rents are expected to go up with inflation. So this income is somewhat inflation proof. You may have fixed expenses (like 15 or 30 year fixed mortgage rates) but your income is likely to grow. If you are disciplined to put the profits back into the property by paying down additional principal, you will accellerate the time it takes to be 100% freehold on the property. Real estate typically takes about 10-15 years to be highly profitable so the earlier you start, the quicker the benefit comes. But at the age of 50, you probably have 15 years left of willingness to run something like this and for what will average out to being just a few hours of work a week, you can have a very solid business. And it is scalable. Once you setup the phone lines, register the business for this, etc. you can start with one building but you can move to many, or use multi-family properties to scale up fast. It doesn't take long to get a lot of "doors" generating you income here, and it is income that keeps coming in when you are old & grey.

And the thing is that if you are willing to give up a percentage of that income to a property manager, you can own property anywhere in the world and generate revenue from it without having to do the hard work. That means that you can easily transition this into a part of your retirement plan. Or you can sell the property and enjoy the profits on the equity increases (after the taxes are paid) and use that money directly. Of course at that time, the growth stops, but you can have an exit strategy. The markets are not normally as turbulent as the stock market, at least historically that has been the case. Some exceptional periods apply (such as 1929 and 2008), but generally it is a far more conservative strategy.

Sure, you didn't put millions away in an index fund to retire on, and you think it is too late. It isn't. You can still earn thousands per month and enjoy the process. The thing is that most of these passive income investments and businesses require a bit of time to "season". Not too long, but it might be a few months to a year before you start to really see them generating revenue at the level you need. And you will make mistakes. You will choose the wrong place to put a vending machine, or buy a building that has issues, etc. The only way to avoid this is to learn from mistakes. The earlier you start the more time you will get to learn. But unless you start to make mistakes you will never learn anything. These businesses are not businesses you can succeed day one at by reading an article on the Internet. They require you to get off your ass and do something.

But here's the thing.... If you haven't saved for retirement, and you had accepted the fact that you are going to be working until the day you die, you are expecting to be doing labor for decades to come. Given the choice of having my income come from assets I own, rather than the fruit of my own labor, I'll take the former anyday. No one rich ever got that way by having a job. The rich don't have jobs. They own things. Start thinking this way and you can break free of this flawed paradigm that our whole society has embraced.

The FI (Financial Independence) and FIRE movement understand this from their 20s. They keep their burn rate really low and they save like crazy. Great stuff. That's a great idea, but if the goal is to retire and never work another day in your life, then that kinda suggests an end-point way to early and more than likely boredom will kick in during retirement and they will just do something more interesting that they are passionate about. At least they have the option to pursue what that is. But by breaking the paradigm, they benefit. You don't need to do that only at the age of 20 or 30 for this to work. By using passive income and scaling it up to meet and exceed your burn rate, you are retired. You are still doing "work" but it really isn't work. It is managing your business and that's the perfect answer to why you don't need to have a massive investment fund with some Wall Street broker. Sure, that would be nice, but then what? What are you going to do with your time? Wither away & die? Nope, how about you get excited about passive income investing and lose the depression associated with not having any money for retirement. It isn't healthy and it won't help you long term anyway.