The US media is frying your brain

Today it all came to a head for me when I saw this... I think we have officially become a failed state. And I blame the hypnosis of the US Media for much of it.

Looking at the equity markets, it seems that we have reached the new age of the Nasdaq dominating the markets. Whereas regular, traditional stocks are seeing a decline in value as they are reacting more normally to the recessionary economy, the tech stocks are offsetting that with stellar earnings. What will the markets look like in 5 years time?

It may be time to bid farewell to considering the stock markets to be reactive to normal economic events, as they are being supported by two major factors:

If the markets are simply a sign of where the future is heading, then it is pretty clear that in the US economy, California rules the roost and those that have access to cheap money are benefiting from this shift.

Every day I look at the markets to determine if there are any obvious gains there that I’m missing. I don’t like to gamble, which is why I wrote “Why I hate the stock markets”. I look for more safe bets, but in a world where a saver is seriously punished, the only safe havens I can see are precious metals right now. Since they are reacting to the downward value of the $USD, it is hard to know if the economy is performing poorly, or just speculators on the value of $USD are just playing the arbitrage game on the Forex markets.

I mean all the indicators suggest a bad economy - you drive out there into the land of small business and you see shops boarded up, “Available” signs everywhere, business closures, etc. Even fast food restaurants are not impervious to this, as I saw our local Carls Jr had closed the other day. It looks like blood on the streets in the retail store land. Even major malls here in Phoenix have closed - the MetroCenter, once the largest of the malls, announced that they have given up and they will probably bulldoze the place and sell off the land for condominiums.

Well you can shove trillions into the chosen businesses, like airlines and cruise ships, and keep them afloat. You can make PPP loans that businesses can find a way to reclassify as “grants” to keep them alive. You can pick the winners & losers here - even prop up the zombie corporations that clearly should have died a long time ago. I mean we have mall real estate owners like Simon Property Group, considering buying JC Penney, Forever 21 and other large tenants rather than see them go under, because they like rents.

At what point should we not just let them die? Like Blockbuster video did when Netflix wiped the floor of the video rental business? Despite those of us who used to frequent Blockbuster, we have to remember that any business that made its revenue from over-pricing candy and fines on their customers for “late fees” on returns, should have never been in business in the first place. That extortion racket should be a monopoly by the Mafia. Oh, and our government wants a piece of it too, but that’s another story.

So if regular free market business is left alone to weed out the deadwood from the markets, and we keep intervening with printing cheap money that just devalues the dollar more and more, how can the markets be expected to behave rationally?

Well they don’t behave like they used to. The one thing that is rational and is relatively predictable is that technology is disrupting and destroying old growth and it seems to be left alone to do this. Consider the recent price spikes of TSLA (Tesla). This is a signal that the future is electric vehicles. Never have I seen such a moonshot in price over this, but clearly the markets don’t like oil anymore. While TSLA shoots up above $1,500 a share, GE is still trying to survive and not go under at $7 a share. Does this not tell us something?

Amazon just cracked the $3,000 price for a share. The growth here is astronomical. Clearly we don’t want to go out to the malls and buy stuff, preferring their gray vans to deliver it to our doors. Maybe that is COVID19 keeping us scared to leave the house, or maybe we are just lazy and prefer to spend the credit card money on Amazon stuff because we have too much time on our hands in said house lockdown and just want to get our retail therapy in some other form. With this going on, one has to question why we need malls at all - or at least not in their current form.

I went to price a new laptop yesterday on Apple.com and was presented with a lovely $4,000 price. As a result, it is still sitting in my shopping cart and probably will never leave it. How can we think of this as sane, when a better spec’d machine from Dell, ASUS or Samsung is closer to the $1K price point. Because the insane social embrace of Apple by the public. They are some mystical god of the future and if you show faith to them, you will be rewarded somehow. Not sure how, but somehow I guess. Well I don’t want to piss off the loyal Apple cult out there - and yes, I run a Mac Pro for my recording studio, so I have plenty of Apple computers around here, but these new prices are just plain insane.

So too is their share price. Again, society values the technology stock as the jewel in the crown. And that reflects overall in the Nasdaq. And now Amazon rule the webhosting world with their AWS product - why? Because IT people are lazy and don’t want to fix their own servers. Yes, I said it. That’s the real reason Amazon is so powerful in all of their profit centers. Because we humans are lazy and don’t want to go to the mall, live in some deferred gratitude world, or have to hunt something down by visiting stores. Now, it seems, we also don’t want to buy servers and host them ourselves, because if they break we might have to leave the house and go and fix them. Better to just pay Amazon to do it, and give up more of our control to the beast.

If you look at the valuations of this sector (the “FANG stocks” as they love to call them), then it pretty much tells the story of where we are going. We have given up doing anything manual or physical. We only want the robots to do it for us - whether that is how we consume our things, how we book a cab, how we find short term rentals, how we host our websites, and how we have our cars drive us. We look to the future of biotechnology to give us a longer life, or a higher life quality, and we punt on who is going to have the vaccine first.

I guess at some point you have to give up and embrace the future with our new technology overlords. Surely you have to do this to play in the casino that is Wall Street. And since there are few other options out there to make a buck these days, then this seems to be the 2020 winner right there.

Maybe the Index funds are shorting the DJIA and punting on the NASDAQ to get returns. Who knows - I just know many folk that are just giving their money to the Index fund as a counter party and letting them have at it.

One sector that always seems to be undervalued to me is the cyber security sector. If the truth of what I unveil here is that we give up our control to the world of technology, then we would want to invest in the checks & balances to weed out the bad guys.

The rush to ship products, whether online or physical, that comes from this massive shift towards technology, comes with the risk of bad actors. There is one general rule in the security space - if you can connect anything to a network, then you can be hacked. Either by direct intrusion, or by someone stealing your data packets and augmenting them to be controlled by them rather than you. This is why, in the military, most weapon grade systems are never connected to other systems. They are completely isolated. But you can’t isolate yourself from the Internet in commercial systems - I mean you try and live off social media for a month and see how that goes.

So we have to spend enormous amounts of money fixing the holes. The problem is that the technology that was unleashed onto the world for this was done with a very short shelf-life and so the most vulnerable products out there are now “legacy” products that have been end of life’d and will never be supported by the manufacturer. Try getting any support for Windows XP these days.

If the tech sector can keep spinning up new stuff, and we are dumb enough to buy it, then they can avoid having to go back to the old stuff and fix it. And of course there is no discount for you to “upgrade”. Like the Apple MacBook Pro at $4,000 I had been looking at, there is no benefit to me other than to get maybe a few bucks in some low end trade in of my old computer. At some point you just wonder if you can make do with what you’ve got.

Can you if it is full of security holes? It really depends on the generosity of the manufacturer. If they accept the responsibility to listen to the hackers who tell them that there are problems and issue patches or upgrades, then yes - maybe that is a company you want to do business with. Thankfully Apple have done that, which might just be one of the reasons they are the darlings of Wall Street.

This does support the statement I’ve always made when it comes to investing - “If there is a gold rush, I want to be the guy selling shovels”. In this situation, there is an enormous amount of money to be made as a “0 Day Hacker”. These guys will get paid to find vulnerabilities and sell that information back to the manufacturers. Normally the malcontent wing of this group would use that to exploit a system for money, but it seems that the manufacturers these days recognize the value of a solid product, and would prefer to give them a serious payment of money for finding the issues so they can patch them. This changes the economics of crime, which is a significant part of the economy of technology.

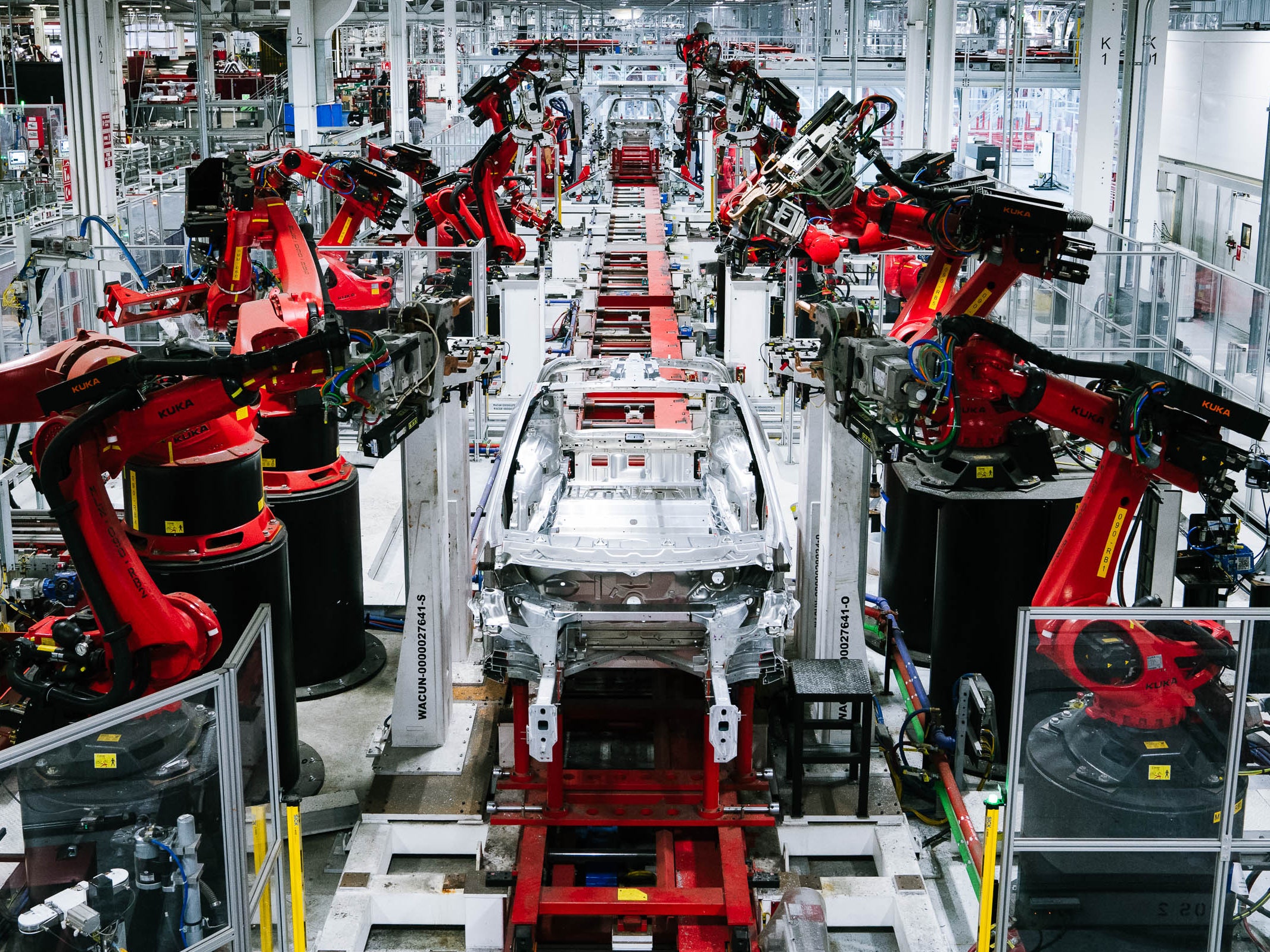

I think it is clear that the macro-economic and “big thinkers” are considering that it isn’t a matter of “if” but “when” as far as letting the robots take over. That brings forward so many social implications, but Wall Street doesn’t care. They didn’t care when GM and Ford displaced hundreds of thousands of good paying union jobs to an army of robots that makes your car. Or when the robots produce the robots, as in the case of Tesla. While there are a huge number of religious followers of “Elon” out there, they neglect to see the impact on society that robots making robotic, autonomous vehicles, has on that sector. Is there a plan for the out of work, used to be “middle class” auto worker? Nope. Move on - swipe to the next news story.

I have had many a debate that there are likely to be some future changes going on as we move towards a world of “only technology”. If no one can make any money on DJIA stocks in the current economy, but they can make good money on Nasdaq, is there any way that we can turn back the clock here? Nope because the money flowing into the likes of Facebook, Amazon, Google, Tesla, etc. will be used to create more robots. And more robots. And more robots.

The robots will create their own robots, and that’s it - game over for labor. So this COVID19 pandemic has become the trigger for the non-human business and with that, and the money, we have committed ourselves to a future path that we predicted only ten or so years ago.

It is not surprising that the election cycle brings up discussions of UBI - Universal Basic Income, because if people can’t work and the robots are doing it all, they still need to survive. With that even the debate over whether capitalism can evolve to co-exist in this new world is had. Those that do not remember or understand that authoritarian communist countries never succeed, seem to want ot revisit that paradigm because they weren’t around when the wars were being fought over it.

Does it mean that the power of commerce defines the 21st century empire, or is it the power of remote controlled killer drones that will do it?

Will money matter at all if you don’t have to do anything and a machine provides all you could want? I’ve always argued that if you want to avoid the collapse of the $USD, then don’t use it. Find a way to get your goods & services by way of barter, trade, exchange, etc. and avoid money altogether. Those that embrace the future of Bitcoin, have done that. They believe that the banks out there are crooks, which is hard to refute, btw.

And that we must, as a decentralized society, regain control of our money. Sure, I’ll go along for the ride there. But if money is becoming irrelevant, then the true currency is who owns, controls or at least has a symbiotic relationship with the robots, AI and machines that are providing us the output that is our food, water, air, shelter, energy, etc. - that person or group of people, clearly will control the world for the future.

Nope, sorry - that ship has sailed. Maybe if you think you can catch a wave from behind, but try doing that as a surfer. The time now is to illustrate the future or at least as you predict it will look like. If you can find an opportunity in that illustration for you that has some tenure, then maybe you have found your answer.

If not, then maybe look to regions on this planet that are less impacted by technology, or who at least have a history that has to be dragged into this new world and it will take time. Hopefully enough time for you to have a working career. Or find regions that have governments that give a damn about their constituents and want to find a way to protect people from the Californians.

If you consider the most successful movies, TV series, etc. out there - what Hollywood is more than happy to fund the making of, you will find them to be shows like Mr. Robot, Homeland, Devs, Black Mirror, etc. which allow us to be entertained by future speculation, but we also have to be cautious about that very future because it becomes more real every day and we see it play out in so many forms.

If there is any glimmer of hope with society getting off the couch, out of the house, etc. it is that the very robots we build deliver us the goods we want. Maybe investing in delivery vehicles, or if there is any hope of people socializing, maybe the high tech robotic vending machines is the answer. I'm seeing some incredible new technologies coming out for this. It really just comes down to whether someone is willing to leave the house and visit the autonomous vending machine. Maybe this is what retail will become. And maybe we need a decentralized electronic currency to trade with them rather than relying on the outdated banking system.

The rise of the Nasdaq is just one piece of evidence that we are moving closer to singularity at a pace that even amazes a contrarian like me.