All things that go up….

No one likes bad news. No one likes negative stories, particularly when they don’t serve their own personal story or narrative. This is the case in politics, in social communication and in the financial independence blogging space. But sometimes you gotta put on your big boy pants and face up that all things that go up, must also come down at some point. And if you really have a strategy that works, it has to work in BOTH the bull & bear markets.

The financial blogging community, particularly those in the Financial Independence Retire Early (FIRE) movement, are an entertaining bunch of regular folk that all have stories to tell. They are like you and I. They are not some rocket scientists, math gurus, or Wall Street experts. Just normal people with jobs, families, hopes & dreams and they want freedom. They tell rags to riches tales - some having reached their goals, others on the path towards them. Their stories become fodder for others to want to go down the same path, follow in their footsteps, embrace their struggle and receive their rewards. The light at the end of the tunnel is freedom. And we all want freedom.

They work hard, save and live in deprivation. They save more than half of their earnings. Keep doing that month after month, year after year. Eventually they will have saved enough money to retire. Then they can tell your boss to shove it and go live on a beach in Bali or something.

Sometimes this journey takes years so it requires a lot of faith to swim upstream like that, and the goal of financial independence in the distance is being fed both by numbers - you see your net worth increasing day by day, and motivation - they want to be told you are on the right path, keep to the path, and eventually you will reach Nirvana. Those that are particularly vulnerable to faith based communities tend to be found in these types of communities. I’m not talking religious folk, but more just anyone that needs motivation and positive affirmations because without it they may find themselves with serious depression. And who would want that - I know I prefer the positive stories with Hollywood endings.

You probably came to my blog because you want to hear me telling you something like that. Like you can have this too. I mean you wouldn’t come here to be given bad information, false information, or unproven information, right? You wouldn’t come here just to be told you are worthless and that you should not have hope for the future. You wouldn’t want anyone to burst your bubble because facing the reality of a world where you never get to realize your full potential, find your calling or be the best you that you can be is a world without hope. Yet all around us, our friends, family members, colleagues, peers, etc. all seem to be going down that path. So you need to know it doesn’t have to be that way. And yes, my friends, it doesn’t have to be that way.

The thing is, though, that many in the FIRE community were raised with the reassurance that “Every child wins a prize”. Just participate in the methodology, and you will be saved. You will become rich, free and independent. Just follow the path.

Like all challenges, there are some that make it and the vast majority do not. Not everyone can be a winner. There is only one “P1” position in a motor sport event. Only one winner. The good news here, however, is that having more money saved is a pretty damn good consolation prize. And it should have been the standard operating procedure anyway. For that, I commend this community of trying to make people less victims to the banks and more aware that they should never sell their future out to someone else, or to a corporation, government or cartel thereof.

Unfortunately 95% of the stories of those that reach “FI” (Financial Independence) that I read are stories of situation - not stories of magic, skills and Hollywood style fiction. And those that are “living the life” and retired early, did it because economic bull markets allowed them to. You have to ask yourself this question - Why is it that the FIRE community didn’t exist in 2001? Or in 1995? Sure, there were other financial independence methods back then, but the truth is that the current FIRE community have traded on equity markets being bull markets, and have never faced the reality that half the time, they are bear markets. Their methods haven’t been tested in bear markets, so now you REALLY have to find faith to stick it out.

History repeats

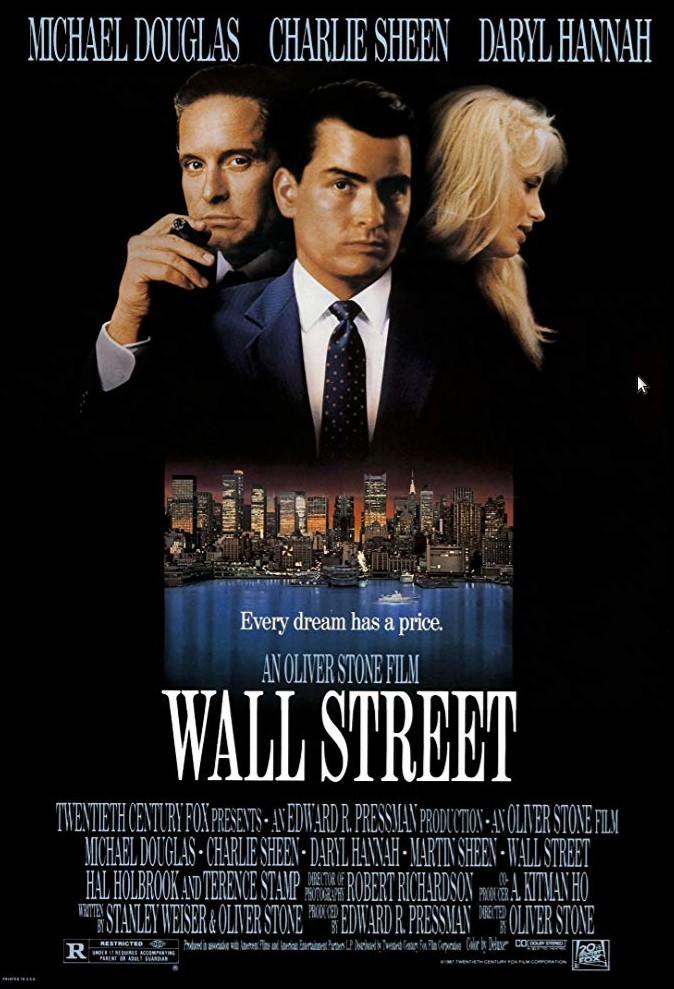

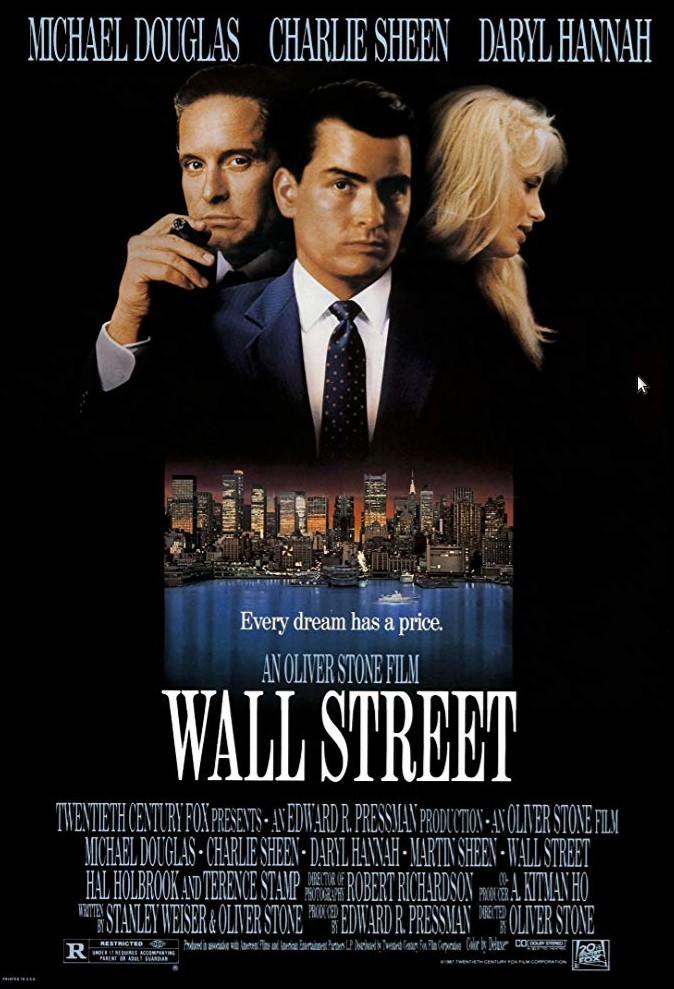

What I saw this week reminded me of the 1987 Oliver Stone movie, “Wall Street”. It is a classic tale and it taught me a lot about human psychology and greed.

There are so many lines of dialog in there that are profound, but the one that comes to mind is from Hal Holbrook, who played the role of wise Wall Street trader, Lou Mannheim. There are a few noteworthy lines in that movie, particularly when Lou tells the young rookie trader, Bud Fox (played by Charlie Sheen) about how the stock markets work:

- “You’re on a roll, kid. Enjoy it while it lasts. ‘Cause it never does.”

- Or in response to Bud saying “Lou, I got a sure thing - Anacott Steel”, he replies “No such thing as a sure thing, except death & taxes... What’s going on, Bud? You know something? Remember, there are no shortcuts, son. Quick-buck artists come and go with every bull market but the steady players make it through the bear market”

Wisdom. Yes, it is codified in a fictional movie, but it is a tale of how life was in New York in the mid 1980s when we were coming out of a bull market. In 1987, the S&P scandals started a massive crash in the stock market and all that helium filled hope popped as those who had hitched their wagons to that balloon came crashing back down to earth.

In 2001, after 6 or so years of euphoria over this new thing called “The Internet”, the Dot Com crash showed that only companies and ventures of substance would survive it, and like how nature kills off the dead wood with bushfires, these crashes tend to shine a light on what actual ventures are of substance and what should never have been invested in, in the first place. After 2001, it took the markets years to recover, as capital flowed out of equities and into real estate, resulting in the greatest real estate valuations and finally the greed of the same markets destroyed most of that for some time in 2008, with the Global Financial Crisis.

These cycles in history will continue to repeat. Depending on how high up the markets go, and probably related to the manipulation of the markets, will determine just how far they have to fall. There will be an ongoing upward trend over long periods of time, as humanity invent new ways to exist better and stronger, and find more ruggedization in how they exist. But it won’t be a linear graph, and if you put your hope and faith in markets to serve you, they won’t always serve you well.

Being careful

So with that, I want to warn you, my reader. Be careful what advice you take and who you take it from. It could be salient advice from Lou Mannheim - the career trader with decades and decades of Wall Street knowledge. Maybe that is advice you don’t want to hear, but consider the source. Or it could be advice from Bud Fox, the young rookie trader who stumbled upon a great opportunity and is trying to make millions from it. Maybe you could follow Bud’s advice, quit your job and live out the rest of your life in freedom. But how many actually will do that?

How many actual investors in Bitcoin, for example, made millions? How many people who bought stock or received options, actually won that lottery? I think you will find we are talking less than 5% of the participants. And yet they often represent the loudest voices in the community.

As I write this, and for the past 2 weeks, the stock market has been in a free-fall. We will probably look back at this period in the future as “The great Coronavirus crash of 2020”. Or they will find some other fancy name for it. But it will be historical. Because the markets have risen to such highs, that they have such a long way to go down. Many will live in denial while this happens, much like those that went through 1929, 1987, 2001 or 2008. No one wants their Hollywood story to not have a Hollywood ending. We all want positive hope, not some “Negative Nancy”.

But this is where the opportunities lie. I’ve written about this before. I love recessions. Why? Because those that have wealth transfer it to those that don’t have it. And normally the wealth transfer is 100x the size of what you would get if you just followed the course of investing in the stock market and “dollar cost averaging” or some other fancy term. The truth is that, as all *real* Wall Street traders know, it is ALL about timing.

Those that make it through the bear markets will know that when the CNBC tickers are all red, they have to work harder to find opportunities. That the red colors are simply the fire torching ventures that should never have been there in the first place. And that eventually there will be casualties, like we saw with Bear Stearns or Lehman Brothers, etc. They just hope it isn’t them. So they would far prefer if the 401K or IRA holder is losing their treasure. If you can’t move things around quickly to avoid calamity, then you don’t win the prize. Sorry about that.

Let me ask you a simple question... If you are waiting on the side of a road that is washed out with a massive flash flood, do you want to continue to go forward knowing that there is a huge chance based on the way that nature is presenting itself to you, that you could be killed? Do you just stay the course because someone back in your past told you to just have faith and keep going? Like it was a noble mission? And that just have faith and move forward?

Or do you realize that you are ultimately responsible for you, and all the other occupants in your car, and maybe this is a time you either want to stop and sit it out, or go backwards knowing that there might be a better path?

FOMO

FOMO, or “Fear of Missing Out”, is a strong trigger in psychology and often the #1 reason people go broke. They feel that if they don’t act when everyone else is, that they won’t get to participate in the winnings. But those that act because of FOMO do so in a flooded market that is normally towards the end of its natural cycle.

There are times you have to look at the opportunities that you see and realize you are too late for it. I return (again) to my analogy about the surfer that I probably use too much. You can’t catch the wave unless you position yourself for it well ahead of it arriving, are prepared and paddle well before it comes upon you. And like any savvy surfer, there are days you don’t even go into the water. Its dangerous out there, particularly for those that are not seasoned professionals.

This is the stock market right now. It is dangerous. I hear terms like trying to “catch a falling knife” when looking at charts. Sure, maybe tomorrow the market will turn around and you will pat yourself on the back that you stayed the course and you will eventually win. But for every $1 you lose as the markets go down, you have to make $2 to get in front of it again. You have to recover your losses and then all you are is back to where you started. The same position you would have been if you didn’t invest in the markets.

Would it not be better to look at this in reverse order and realize you sell at highs and you buy at lows, and that timing matters? Isn’t that how the world has worked since genesis? Why would it not be the same today? Maybe if the game is rigged, then you could possibly win something, but then would you really want to play in a rigged game?

My advice to you, my friend, is that you have to be very careful right now. I won’t advise you on what to do with your money, but I will tell you what I’m doing with mine. I got out of equities over a year ago, and I bought Gold. Only because I knew this time would be upon us. I knew that markets go up and markets go down. I knew that because I have been a victim to false hope before. And it hurts. It really hurts. Particularly when your hopes and dreams of your future are dashed by some massive calamity.

I won’t hold Gold forever. I’m not some Gold evangelist. I see it as safety, particularly in times when markets are not safe. But when the dust settles, I’ll cash it out and buy up the opportunities left scattered on the ground by those that lost out to FOMO, or just followed in a faith based mantra of moving forward at all costs, while their cars were destroyed and washed out by the flash flood that is the stock market crash.

But be particularly careful of those that are telling you that nothing is wrong, that there aren’t any real dangers out there, and that you need to follow the path towards salvation and freedom because life is a constant ever improving journey and that there are never downward or bear markets, or that you would do better to bury your head in the sand like an ostrich and pretend that the bad markets are going away and you can avoid all that pain & suffering by embracing ignorance. I can tell you from personal experience, that never ends well.

There are times to be in a market, and there are times to be out of it. The most important thing is you protect your treasure. You learn that the euphoria of abundance is a double edged sword when that abundance disappears. And you learn that you probably should have been listening to Lou Mannheim all along, and not Bud Fox.