I’m from the Government, and I’m here to help.

Governments are, by their nature, dysfunctional. They suffer the same challenges any large organization has, except they don’t have any profit motivation to have workers go the extra mile to get things done. Case in point - the recent SBA EIDL Loans offered to US small businesses. Spoiler Alert - It’s a trap.

In early 2020, the COVID19 pandemic happened. No one (as I write this) has explained where it came from with any form of validity. But what it did was to kill masses of people, and leave cities, states and countries dumbfounded as to what to do about it. Pandemics like this don’t happen everyday, and trying to go back in time and find anything of this magnitude was difficult.

Some compared it with the Spanish flu of 1918. Some even went back to the Black Plague of the middle ages. In reality, we didn’t know. Was it just a bad flu? Was it a death sentence? Who knew. But over time society started to grapple with it and try and work out how best to protect its citizens. Meanwhile more got sick, hospitals overflowed, and more and more people died.

The problem was that while everyone was in shock, we had to shut down the entire country. People were forced to shelter in place. Quarantine, martial law, curfews, etc. It felt like some military occupation and although a lot of good things came from this, including a chance for nature to thrive without us pesky humans beating it up all the time, or families were forced to actually spend time with each other, or workers were forced to be remote, avoid commutes and traffic congestion and not rely on their workplace as a social gathering, rather a place to get work done, in truth this was difficult for anyone to deal with.

Anger raged, frustration reached boiling points, no one could get a haircut for 12 weeks, forget going to the gym, etc.

And the innocent victims in all of this were the very businesses that offered those services, and typically they were small businesses.

Government responds

Small businesses don’t have the resources that the large or corporation organizations have. They don’t have deep pockets, they can’t raise capital like a big organization can. And since they employ roughly 50% of the workforce, if they go down, the half of the employment goes with them. This is an instant pathway to economic depression, and that worried the government, particularly in an election year.

So the federal government did what the federal government does. They went to the central bankers and told them to print more money. Lots of money. They raised the national debt from $23T to $26T almost immediately with the blessing of congress who also wanted to be re-elected again. And although only a small portion of that money was earmarked for small businesses, it was a good start.

The Small Business Administration (SBA) started offering grants. Initially they allocated $10,000 per business as a starting point, but it could be more depending on the losses that those businesses were likely to suffer. After about 1 week of doing this, the SBA realized they didn’t have anywhere near enough money. They dropped the grants down to $1,000 per employee. They took millions of applications for this money. Many small businesses needed much more, so they would apply for PPP loans - loans that would be provided to them at low interest so that they could at least pay their salaried workers.

But there was a catch. The PPP loans didn’t need to be paid back if you could show that the funds were used to keep your employees employed. In reality, the SBA was using the small businesses as a welfare program for workers. Those workers would still be technically “employed” and receiving a salary, and therefore not counted as unemployed, but they were furloughed so they didn’t have to work at all. As long as the business didn’t lay them off, they could avoid having to pay back those loans.

The problem was that the businesses couldn’t get the funding fast enough. Many just gave up and shut down completely. Others had enough to get through waiting for their local banks to do the paperwork, get the funds and disperse them. But that could take weeks, sometimes months. And remember - those banks furloughed their employees too, or forced them to work from home. They were at a disadvantage in keeping up with the paperwork backlog.

The reality was that what was used as a political speech and promise to make sure that those affected by this unpredictable disease through no fault of their own would be ok, didn’t go according to plan. Why is it that anytime a government comes to the rescue, they seem to screw things up even further? It is one thing to suffer a calamity such as COVID-19, but to be given empty promises that your government will make you whole and then be dropped like this, is just salt on the wound.

Meanwhile the state governments started to get unemployment claims for welfare at levels they had never seen before. At the time of writing this, over 44 million claims for unemployment had been received. Considering that the total workforce in the USA is a little over 200 million people, that’s 20% of the entire workforce right there, and remember that those companies that got the PPP loans were not allowed to lay off workers, so they were already funding welfare to their employees? They were not counted in those numbers. Nor were any self-employed or freelancers that chose not to apply for unemployment.

But it got worse

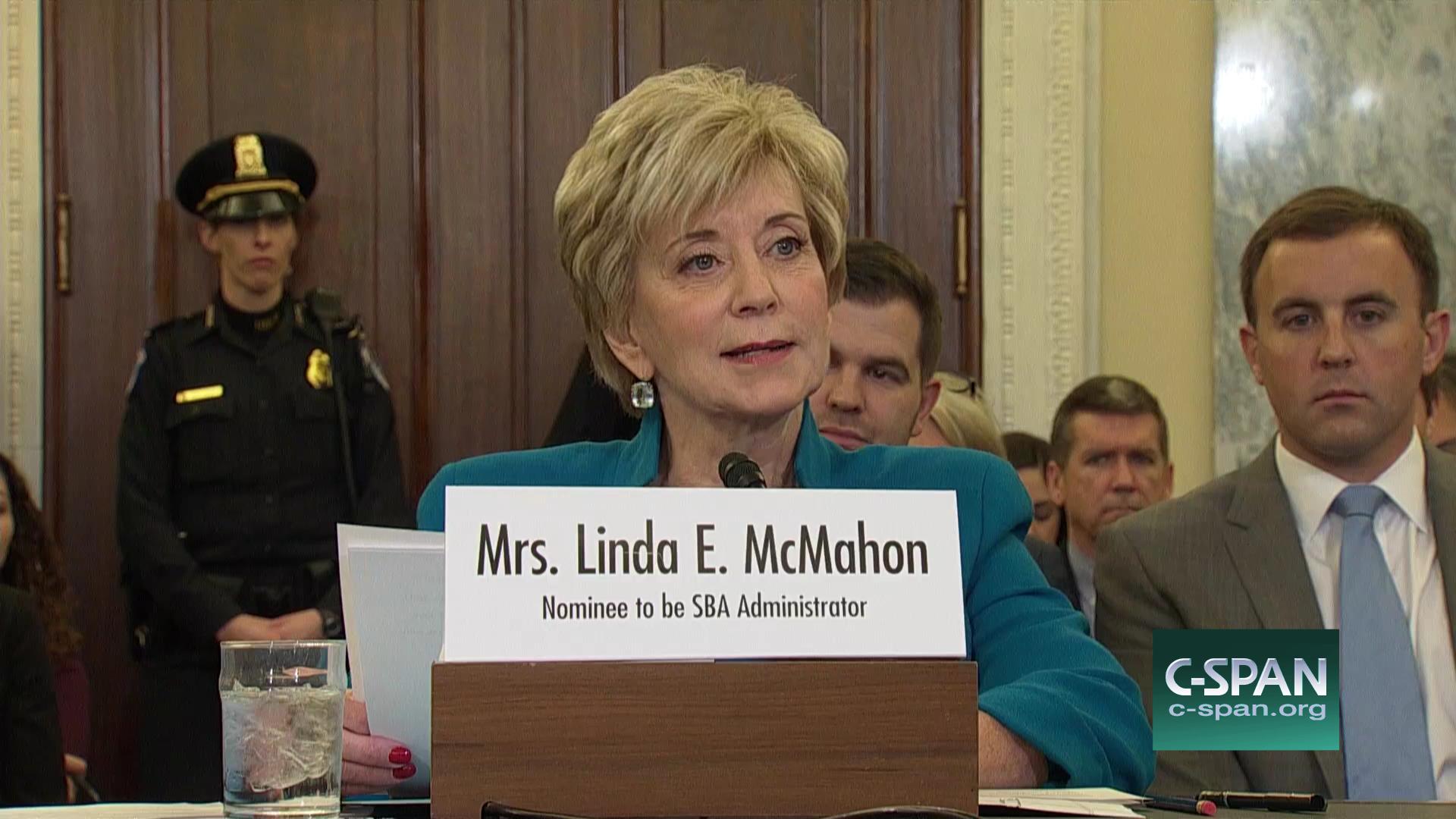

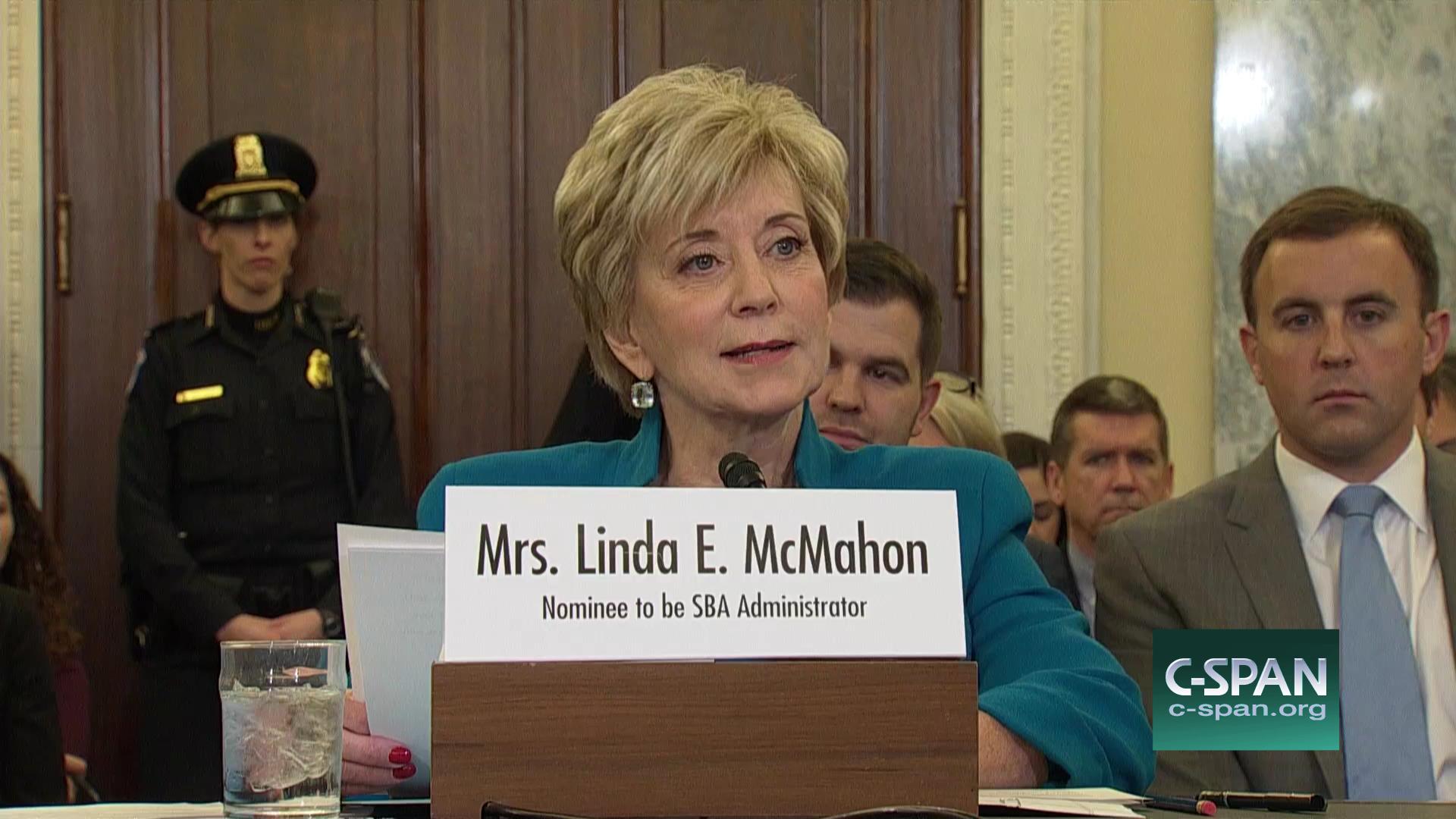

Congress, who appropriated the trillions of dollars of funding were furious that the money wasn’t going to the intended recipients in any meaningful way. The senators and legislators realized that the blow back for taking on so much debt here that didn’t have a calming effect on the citizenry would kick them out of office at the next election cycle. So they hauled the head of the SBA in front of congress for a vicious grilling session.

The result was that the SBA went back to applicants and asked them to re-apply or update their requests for grants, etc. This time armed with much more money to throw around.

They raised the stakes, but they now had a few more weeks to think about how they wanted to do this. They couldn’t give money to just anyone. There had to be a catch. If the business really wanted a loan, they could get it but it seems they created a series of “terms & conditions” that really exposed the true nature of government and control.

In this round of funding for loans, the idea of a “grant” was scaled back so that all the money was considered a “loan”. If the business wanted more than $25,000 of funding, it came with a lot of catches. First, the interest rate was low (3.75%) which was far lower than most commercial lenders. And it was for a 30 year term, like a mortgage. And the business didn’t have to make payments on it for the first 12 months. I mean this is the government making it rain with money.

However this now required collateral. That is you had to put up something of value to get the money - your house, your business, your inventory, something. If the collateral was acceptable, then you could have the money.

But the catches continued. What you could spend the money on was heavily regulated. I mean now the SBA had weeks of planning on how to lock down the money. You had to only spend it on certain things, and you needed a CPA to work out what would qualify and what would not. It was much like knowing what a qualified tax deduction was on your expenses.

Then came the further draconian threats. The SBA wanted to ensure that your collateral was in good standing, so you had to maintain it and you had to keep it valuable. And that also meant now that they had the right to audit you - they could audit your spending of the money, and they could audit your collateral to ensure that they had protection should you default on paying back this loan.

All while realizing that the money they were giving you was tax dollars you likely had paid them over time. Sure, it wasn’t directly measurable against what you had paid them before, but they borrowed and created debt for that money so someone had to be responsible for it.

The moral of the story

In the world of finance there are “hard money lenders” who are like sharks - they charge ridiculous interest rates and their enforcement of getting paid back is usually pretty severe. Often they wrap themselves up in companies like title loan or pay day loan companies. But you know what you are getting into. You don’t want to deal with those sharks because it never ends well.

Then there are regular commercial financing - typically done with banks. Small businesses know about this, but because they don’t have any predictability of income, it is harder for banks to loan to them and normally the rates are much higher. Sure, there may be collateral required for such loans, but you know what you are getting into. There are regulations that those lenders must operate under that was written up by committees created by the very same congressional elected officials to protect the citizenry from harm.

But now things are different. Now the very same government, tasked with helping out the citizens with money, employment, etc. are using that “provider of last resort” position as a way to enslave and constrain small business owners. If they didn’t save for a rainy day, and let’s face it - this is a flood, not some rain storm, then if the only provider of capital is the government, and since the very same business paid them taxes in the first place, you would hope that they are willing to provide assistance.

Yes, the government that has the power of the gun to force you to pay them taxes, now is using that same power to loan it back to you and control how you can spend it, and how you can operate in regards to your existing assets.

Look, I can’t advise you that if you are in the situation of losing your business over this pandemic, that maybe you have no choice other than to take a loan out to hopefully get through this. But the reality of the situation is that even if a vaccine was released tomorrow for this and the world was able to get back to normal again, it won’t be the same normal. People won’t spend money unless they have to because they are scared and want to sack away nuts for the winter. They won’t have jobs for some time, so liquidity is going to be low. Unless you offer some essential service, you are not likely to see the glory days of the pre-COVID19 period for many years. That means you will have the burden of this loan to pay off, and yet be operating in less than profitable times.

And you are subjecting yourself to the long arm of government infiltrating your life - like Big Brother looking over your shoulder all the time. Watching how you spend your money, not trusting that you are doing things with the best intentions and you are going to be considered guilty until you prove your innocence in their eyes.

If you can avoid taking their money, avoid it. Please don’t fall for the same trap as everyone else with student loan debt, credit card debt, car payment debt, etc. Look I get it - no one saw that virus coming, and you are not to be blamed for it. But just as you were not to be blamed for an earthquake or a tornado or a hurricane, shit happens. And if you are the sort of person that can accept that, get through the five stages of grief and learn to recover on your own, you will be much, much, much stronger on the tail end of this. You will not have debt, you will not have your government breathing over your shoulder for the next 30 years. You will not have the burden to pay this money back because you never took it in the first place.

I don’t know what is better for you - keep trying to run your business with government money and more regulations and oversight, or accept that shit happens and get out cleanly and try and start again. Sure, I know with these things people get hurt. I’ve been through this before myself, so I get it. But I didn’t take loans to try and keep a sinking ship afloat. I know a zombie company when I see one, and sometimes it is better to fail and get out than to perpetuate a future knowing that the world will not be as it was.

I’m not advising you on what to do. I just want to shine a light on the different angles of this you are probably thinking about. To quote President Ronald Reagan from 1986:

"The nine most terrifying words in the English language are: I'm from the Government, and I'm here to help. "

Reply | Quote and reply

Reply | Quote and reply